Once again, digital banks are processing stimulus funds days ahead of some of the country’s largest banks, an example of how the smaller, branchless institutions are beating incumbents in the stimulus disbursement arena amid the pandemic.

Digital banks Green Dot, Chime, Varo Bank and Current began crediting eligible customers with the coronavirus relief funds Friday morning, less than 24 hours after President Joe Biden signed the $1.9 trillion relief package.

Green Dot, which said it has processed stimulus funds totaling $2.6 billion so far, said it ramped up its stimulus-focused customer support teams and overall user experience and educational content and communications to help customers prepare ahead of the passage of the latest coronavirus relief legislation.

"We also ensured our bank had the liquidity necessary to get eligible customers their funds as quickly as possible once the bill was passed and orders were received," CEO Dan Henry said.

Green Dot, like Chime, Varo and Current, didn't wait for the funds from the IRS to settle before depositing them into customers’ accounts.

"Taking this approach comes at a cost, but we believe it’s the right thing to do," Henry said. "We’re proud of how quickly and effectively we’ve delivered these critical funds to our customers — and while we’re continuing to learn and refine processes across the board, this has been the smoothest and most efficient round yet."

For digital banks, crediting accounts early is part of the business model, and was in place before the government first began issuing pandemic relief almost a year ago.

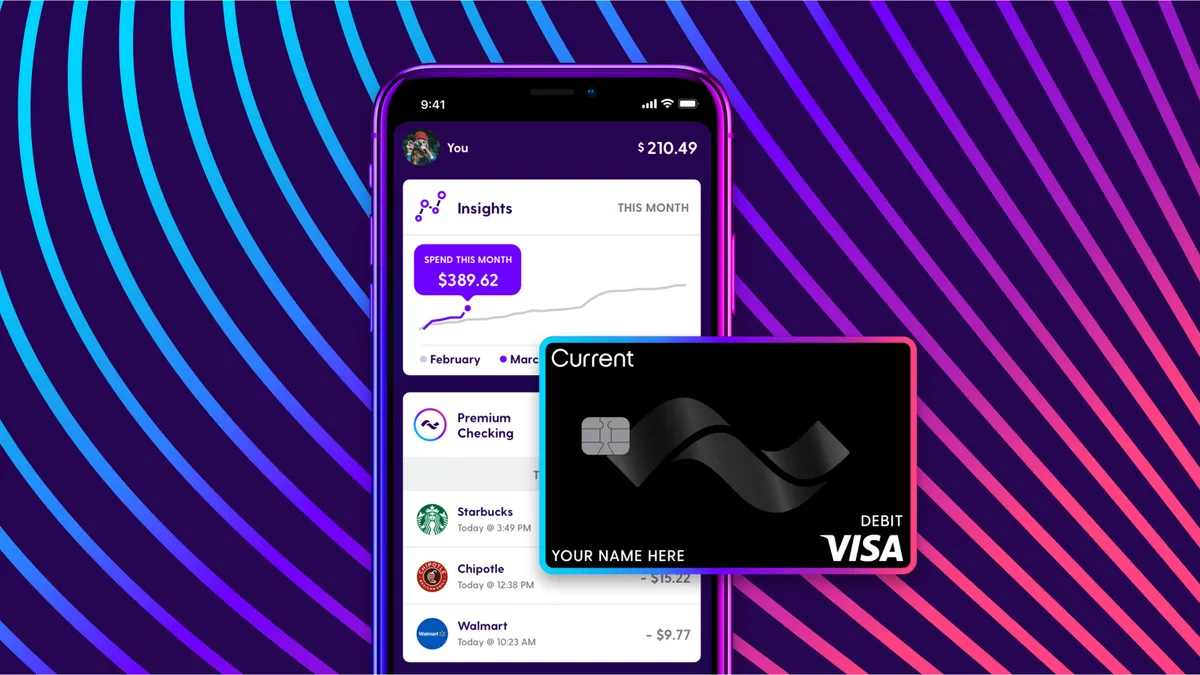

"We credit paychecks up to two days faster every single day. That includes unemployment checks and government checks," said Erin Bruehl, Current’s director of communications.

The New York-based challenger bank said it began crediting accounts with the latest stimulus as early as 11 a.m. Friday.

"Fronting the money using our own balance sheet is what we're doing on a day-to-day basis. For us, it’s not a stretch. We're fully prepared," Bruehl said. "With government checks, there's zero risk because it’s guaranteed money."

Financial institutions get notifications when a payment is coming from the National Automated Clearing House Association (NACHA), the organization that manages electronic transfers. Challenger banks that offer early access to funds simply credit their users’ accounts when they get the notification that a payment is on the way instead of waiting for the actual settlement date.

Large lenders such as Wells Fargo and JPMorgan Chase have told their customers they can expect to see the funds in their accounts Wednesday, the IRS’s official payment date, causing some customers on Twitter to speculate the banks are holding on to the money to accrue interest, or because a delay in payout may spur a spike in overdrafts.

Wells Fargo disputed that idea in a statement emailed to Bloomberg on Sunday, saying the bank is simply providing the payments to its customers on the date the funds are available, "based on IRS direction."

Challengers get a boost

A spokesperson for Varo Bank, the first challenger bank to gain a national bank charter last summer, said it has processed $150 million in stimulus payments for "tens of thousands" of customers so far. Fellow fintech Chime tweeted Saturday its members had received more than $3 billion in stimulus payments.

Current said it has seen an uptick in users with each iteration of the government-backed coronavirus relief payments.

"Our growth has been exponential in the last year. We doubled our member base in less than six months from each round of stimulus," Bruehl said.

Current, which declined to share how many accounts it has credited with stimulus funds in the most recent round, passed 20,000 stimulus payments to customers last April. The digital bank said it had around 800,000 customers at the time, many of whom live paycheck to paycheck.

With a large number of users most likely to qualify for the government relief, coupled with the speed with which they are able to deliver that relief, digital banks are favorably positioned to capture market share from incumbents, said Lane Martin, a partner at consulting firm Capco.

"Stimulus payments are certainly accelerating banks’ recognition of digital deficiencies where they exist, and action is underway to address these shortcomings across the industry," he said. "Enhancing customer servicing using digital and modern tactics will improve the customer experience and help eliminate past stagnation to address infrastructure concerns at incumbent institutions. Digital banks are nimbly making strides, and incumbents are fully captivated."

Green Dot’s Henry said digital banks’ response to delivering the payments early demonstrates there’s room for growth and innovation in the banking sector.

"This further illustrates the opportunity for newer and more innovative banks to come in and serve an important audience that’s been ignored and taken advantage of by traditional banks for decades," he said. "These are people who desperately need and would benefit greatly from faster, more affordable, and more seamless banking and payment solutions."