Dive Brief:

- Discover Financial Services has stopped taking applications for a new checking account that offers cash-back and debit features, saying it encountered too much fraud. It had begun selling the new service in April.

- After launching the product, Discover “pulled back on the marketing because of the amount of fraud we were seeing,” CEO Roger Hochschild said Tuesday at the Goldman Sachs financial services conference. Applications were suspended over the summer, and the company will resume taking applications for the product in early 2023, a Discover spokesperson said Wednesday.

- The financial impact of the fraud was “manageable,” but it caused service levels to deteriorate, which led to the company’s decision, Hochschild said. Discover will relaunch that product next year “with some more advanced capabilities,” he said.

Dive Insight:

The spokesperson declined to comment on the type of fraud the company encountered, the financial impact Hochschild referred to, or the capabilities that will be added to the product before it’s relaunched next year.

Riverwoods, Illinois-based Discover announced in April it had relaunched its checking account, powering it with cash-back rewards and early access to paychecks.

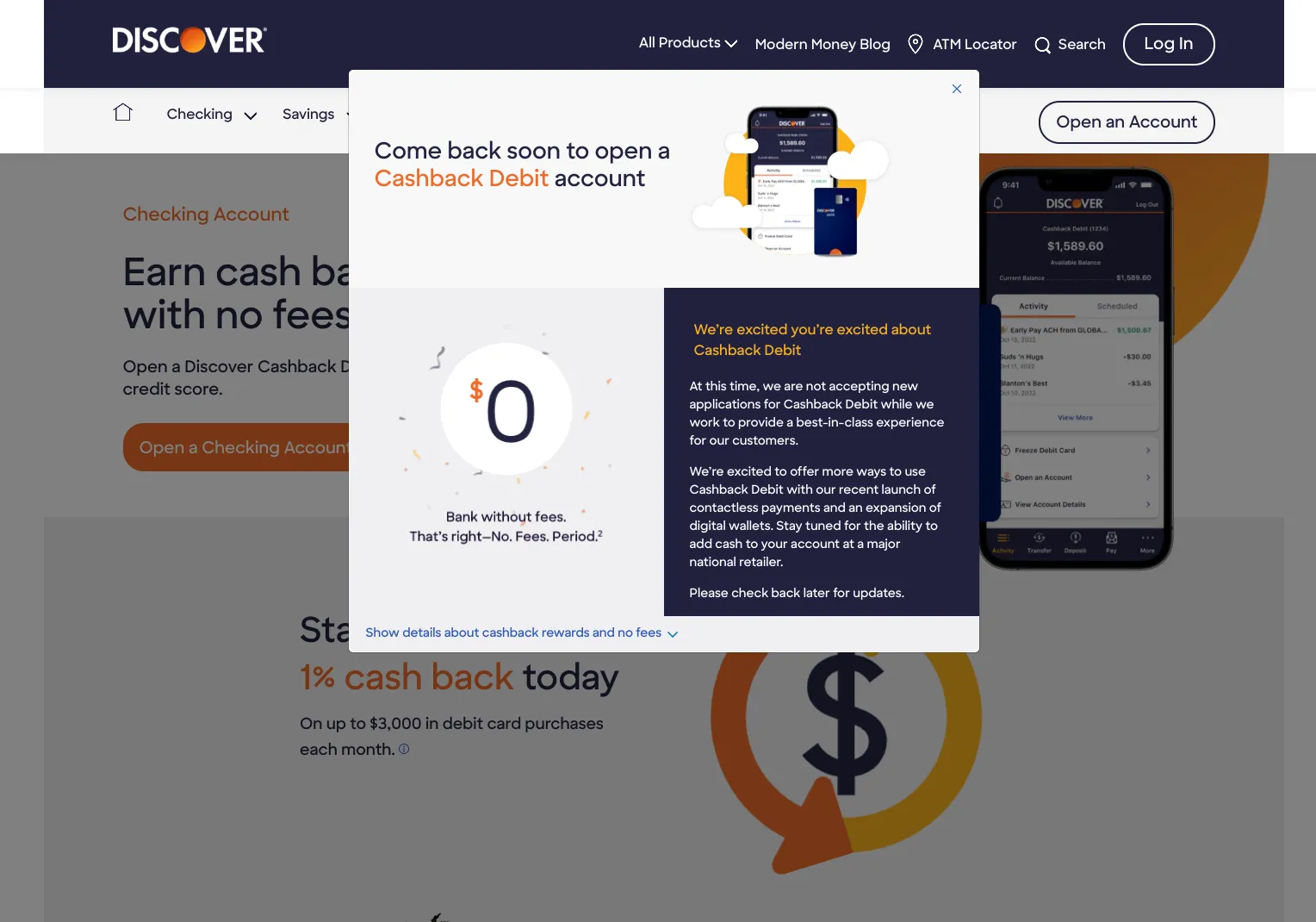

“At this time, we are not accepting new applications for Cashback Debit while we work to provide a best-in-class experience for our customers,” a pop-up window on a Discover web page noted until Wednesday. “Please check back later for updates.”

Discover’s move is likely indicative of “growing pains of a new product” as the company ensures it has the right fraud solutions and analytical technologies in place, said Oppenheimer & Co. senior analyst Dominick Gabriele. The company also might be focused on ensuring the product is drawing in the type of account-holders it’s targeting, the analyst said.

Still, it’s uncommon for a company to launch a product only to suspend applications for it, said Gabriele, who focuses on fintech and specialty finance. He wasn’t sure what type of fraud the company was referring to, and said the financial impact of the situation is “something you would like to have a follow-up on.”

Ultimately, Discover has “an incredibly prudent group of managers,” and it’s a positive step that they would act quickly to address such an issue, Gabriele added.

The debit product is a big focus of investment for the company as it can provide a new entry point for consumers to find additional services, Hochschild said Tuesday.

As debit card use has increased, other payments players, such as Affirm and Block with its Cash App card, are also counting on debit cards to fuel growth.