Dave, a neobank and personal finance app, announced Tuesday that it’s just quarters away from profitability — a marker that fewer than 5% of neobanks achieve, according to market researcher BAI.

To get there, Dave CFO Kyle Beilman said it’s leaned heavily into artificial intelligence — technology that’s grown more popular in the banking sector in recent years.

Dave’s most popular product, ExtraCash, is a no-fee cash advance where customers are approved based on their checking account history, rather than their credit report.

Dave released its first-quarter earnings report Tuesday, and credits the company’s proprietary AI technology for low delinquency rates despite macroeconomic market challenges. While ExtraCash originations increased 46% year-over-year, the 28-day delinquency rate improved 67 basis points to 2.60%, according to the earnings report.

“We have over 8 million members at this point and our team is only 320 people. The ability to scale in that way ... demonstrates the technology and the capabilities that we've built around, not just underwriting which is a major part of the innovation that we've brought to market, but the broader sort of technology stack that we have as well,” Beilman told Banking Dive.

Unlike conventional lending products, ExtraCash doesn’t bring in revenue through interest. Instead, it brings it in through gratuity. Beilman said many customers get on board with the idea because it’s “a really fair value exchange.”

“If you're coming to us, and we're helping you avoid a $35 overdraft fee or really getting you out of a pinch, you have to ask the customer, ‘Hey, there's no mandatory fees here. What's that value worth to you?’ [People] are willing to pay for it because we've done something that's very helpful to them,” Beilman said.

Most people just tip a few dollars, but it adds up. ExtraCash accounted for roughly 80% of Dave’s revenue in the first quarter. While the average ExtraCash advance totals around $150, Dave customers tapped into $798 million in advances in the first quarter.

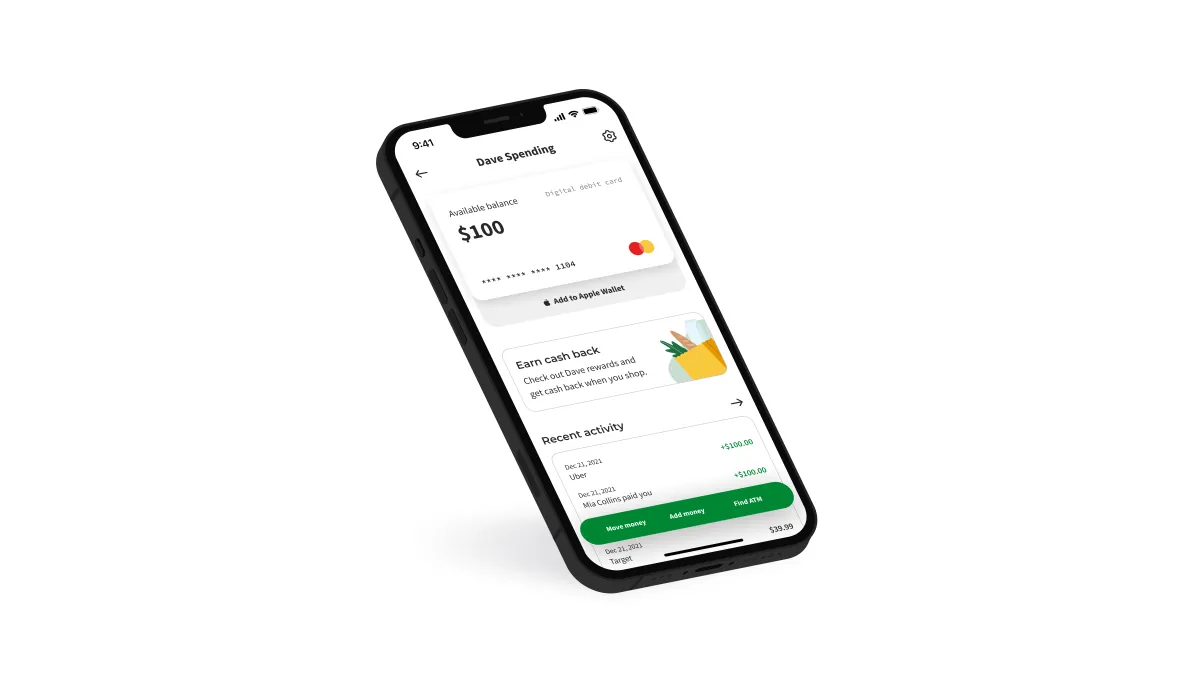

Some of that revenue is driven by expedition fees for folks who opt to have their ExtraCash sent to external personal bank accounts, instead of kept on their Dave debit card. And though he declined to disclose what percentage of customers have ramped up their Dave use beyond ExtraCash into its debit product, it’s a part of the business that’s seen recent growth.

“If you look at our financial statements, our debit card engagement and debit spend is represented in our transaction-based revenue, and you can see that the revenue has accelerated really, really quickly since [the third quarter],” he said.

Dave customers’ debit card spend increased 62% to $295 million in the first quarter, from $182 million, the earnings report said.

Interchange fee revenue has grown alongside Dave’s debit card product.

“The great thing about growing the interchange part of the business,” he said, “is the fee is borne by the merchant, not the customer.”

Another piece that has edged Dave toward profitability, Beilman said, is smart marketing spend. The first quarter tends to hit Dave with a “seasonal dynamic,” as fewer people seek out ExtraCash because it’s tax refund season. Knowing that, Dave’s year-over-year Q1 marketing spend was $9.5 million this year versus $12 million last year.

“But instead of acquiring 460,000 members for that $12 million in marketing that we spent Q1 of last year, we acquired 587,000 members this quarter, so we spent less and acquired more customers,” he said.

Beilman said “a couple factors” are at play.

“Ad markets have become more favorable as crypto and other venture-backed businesses have really pulled back on marketing, so inventory is cheaper,” he said. “But more importantly, our value proposition is resonating better in today's environment than it was last year, given the current macro backdrop.

“We see higher engagement with ads and a higher conversion to new customers for that reason,” Beilman added. “There is more of a need for what we're offering right now.”