Cushion, a fintech designed to help consumers stay on top of their buy now, pay later loans and other bills, has shut down, according to founder Paul Kesserwani.

Kesserwani said on LinkedIn that he decided to wind down the firm at the end of last year.

“Despite bringing multiple new fintech products to market, we didn’t reach the scale needed to sustain the business,” he wrote.

Founded in 2016 as an overdraft fee negotiation fintech, Cushion switched gears in 2020 when Kesserwani realized how challenging it was to keep track of BNPL loans.

“After three purchases, I was like, ‘I have a computer engineering degree and I have a team of PhDs and I can’t for the life of me stay on top of these freaking payments. This is so confusing,’” he told Banking Dive in 2023, describing the personal experience that inspired him to change focus.

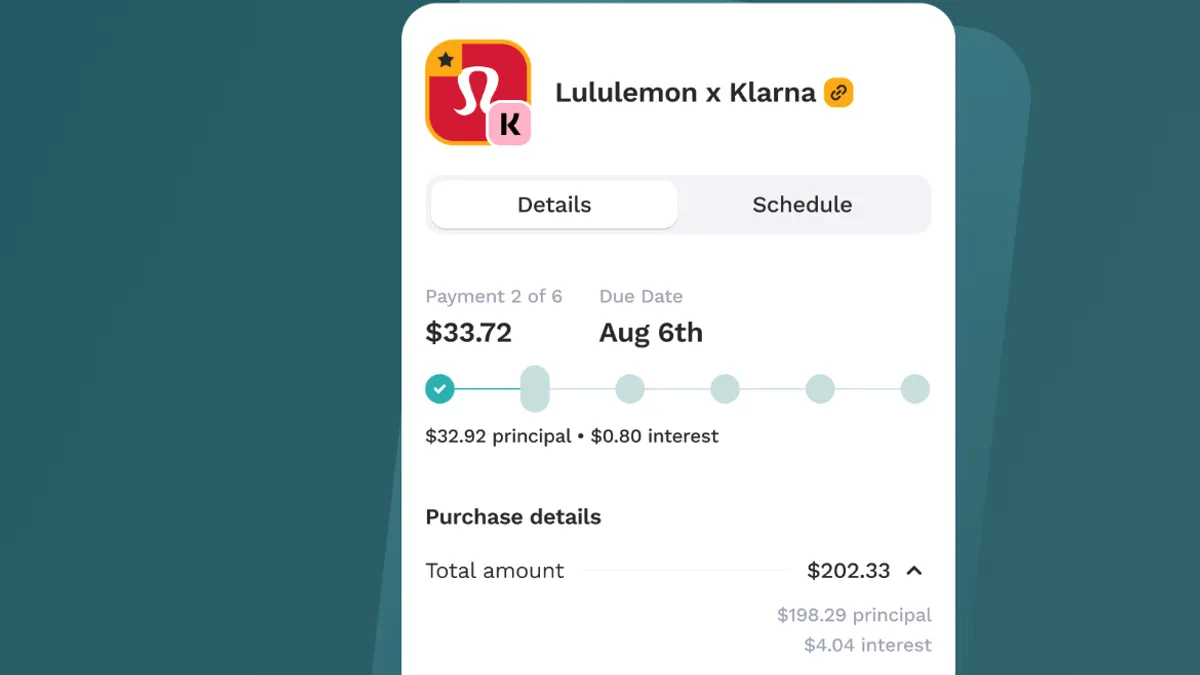

His team spent two years building Cushion’s BNPL and bill aggregator, which combed through users’ emails to compile all the bills and BNPL loans they needed to speak for.

The aggregator was launched early in 2023. Cushion also offered a credit-building virtual payment card.

Since its inception, Cushion had raised more than $21 million from investors and venture capital firms such as Flourish Ventures, Vestigo Ventures and Better Tomorrow Ventures.

With those investments, Kesserwani said Cushion secured $15 million in bank fee refunds, processed $40 million in payments in under a year and built “the only ‘Plaid for BNPL’ on the market,” processing 30 million emails and over $300 million in BNPL loans.

Its most recent publicly announced raise, of $12 million in May 2022, raised Cushion’s valuation, according to PitchBook, to $82.4 million.

“I gave Cushion everything I had for 8+ years,” Kesserwani wrote on LinkedIn. “While the outcome wasn’t what we hoped for, we built something that moved the industry forward — and I’m proud of that.”

Cushion’s winddown aligns with expectations laid out in F-Prime Capital’s 2024 State of Fintech report, which projected “many challenging fundraises, distressed sales, and shutdowns” in 2024.

A number of other fintech firms folded in 2024, including credit card debt management platform Tally. Tally sunsetted due to capital issues. A significant number of other fintechs conducted layoffs.

Kesserwani did not return a request for comment. Neither did several of Cushion’s investors.