Amid a worsening economic climate and inflationary pressures, digital banking startup Current dropped its subscription fees this year — a cost it said it can absorb by building its own payment processing infrastructure and eliminating the need for a third-party payment processor.

Trevor Marshall, the company’s chief technology officer, said the move highlights the company’s focus on customer retention, user experience and the ability to add products and features more quickly than before.

“We've been able to start expanding a lot of the technical capabilities that we have … to improve the business model significantly and pass that back to customers through points and removing our subscription fee,” Marshall said. “You have to have a sustainable business, but we had a lever that other people didn't have, which was we can actually cut costs sufficiently that we don't need to fill that hole with a subscription fee.”

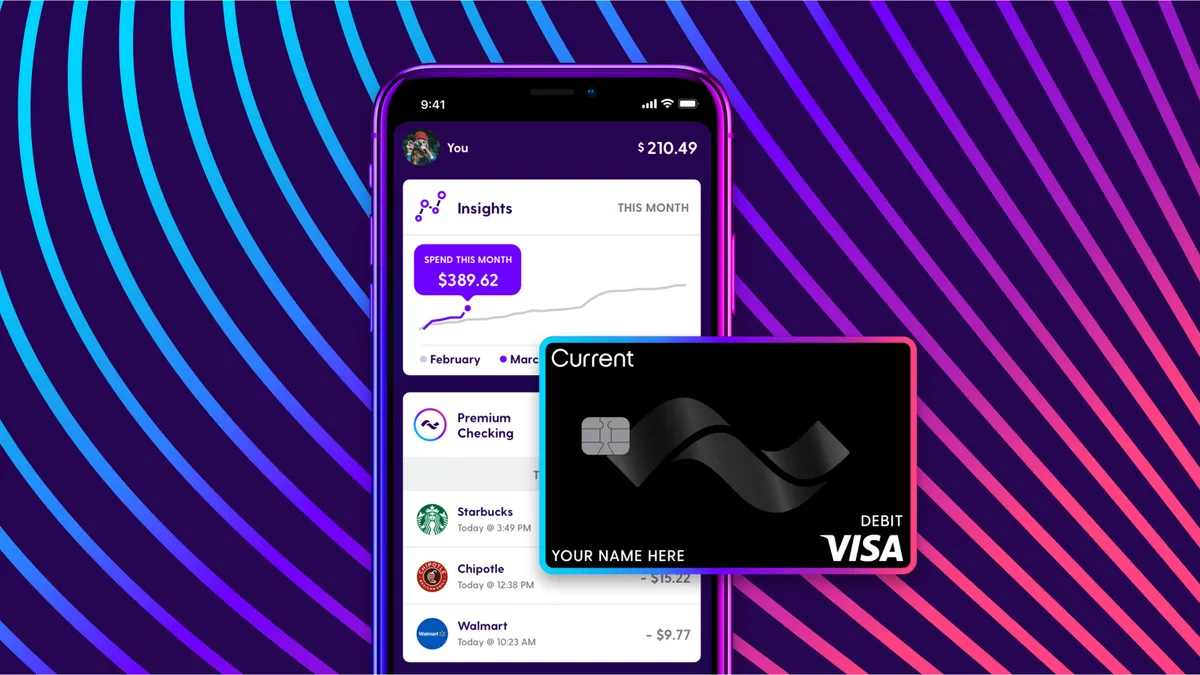

The 7-year-old New York City-based company launched a teen banking platform in 2017. It’s since expanded to serve consumers of all ages, offering checking accounts with high-interest savings “pods” and crypto trading. Current partners with Choice Financial Group to offer banking services. The company dropped its $36 annual fee for teen accounts in February and its $4.99 per month fee in April, Marshall said.

Spurred by the growth of Amazon and streaming services, subscription commerce was once hailed as a revenue builder for consumer-focused companies. But recent research suggests consumers may be pulling back. Nearly two-thirds of U.S. consumers have either canceled or are likely to cancel a subscription in the next 12 months, according to a global streaming services study conducted this year by consulting firm Simon-Kucher & Partners.

Bringing payment processing in-house

Current generates most of its revenue from interchange fees. The company, which had been previously working with a third-party payment processor, built out its own banking infrastructure over seven years — including a custom-built ledger and processing capabilities. By October, all customer transactions were moving through the company’s proprietary payment toolset with Visa DPS Forward, a cloud-based issuer-processor platform.

“We’re able to create a better experience because we're now getting much more granular information directly from the networks,” Marshall said.

By doing processing in-house, Current is able to cut costs. The company saw a 30% increase in gross margin by doing its own processing, allowing it to pass savings on to customers and drop subscription fees, the company said.

The toolset also allows it to easily add new products and features, including, possibly, credit products in the future.

“It allows us to work directly with Visa on building differentiated products versus waiting for a third-party processor to add those capabilities and having to make a case for them, et cetera, in order to launch a product,” Marshall said. “We’re excited about the ability to blend credit into what has traditionally been a debit experience for us.”

In-house technology as a differentiator

Current’s approach differs from the route neobanks typically take, which is to work with third-party processors to get products out to market as quickly as possible, said Alex Johnson, a fintech analyst.

“[Current’s] premise has always been that [for the] experiences that they want to deliver … they need to have a lot of control,” Johnson said. “They don't want to just do the same kind of cookie-cutter stuff that everybody does.”

There are two key risks to this approach, Johnson said. First, proprietary infrastructure is expensive to build and maintain. And second, the company needs to ensure sufficient transaction volume to make the investment in back-end technology worthwhile.

Current said it’s meeting these challenges through the lessons learned from building its core toolset in-house.

“We've been fortunate to learn as we've grown, and that learning has happened naturally over the last seven years,” Marshall said. “Our core would be far more difficult to build at our current scale now. We've also been able to hyper-optimize costs along the way.”

Credit products could build a pipeline for additional revenue, Johnson said.

“Launching a credit card, which is going to be probably a higher-revenue product than their debit card, ... adds up to them trying to drive more revenue and probably get to profitability, which again, makes sense in this current environment,” Johnson said.

Current said it plans to do a future fund-raise, but it also has taken steps to maintain its financial footing despite economic pressures, Marshall said.

“We were quick to respond to market conditions that allowed us to be efficient with our money, including managing costs, marketing spend and hiring efficiently,” he said.

Current has 4 million customers and has raised $403 million to date, including a $220 million Series D round in April 2021 led by Andreessen Horowitz.