More than 80 million Americans are expected to receive coronavirus stimulus payments in their bank accounts today, U.S. Treasury Secretary Steven Mnuchin said Monday.

But at least 20,000 Americans received their relief days ahead of schedule, according to digital bank Current, which said it received its first government stimulus payments Friday and began passing them to customers immediately.

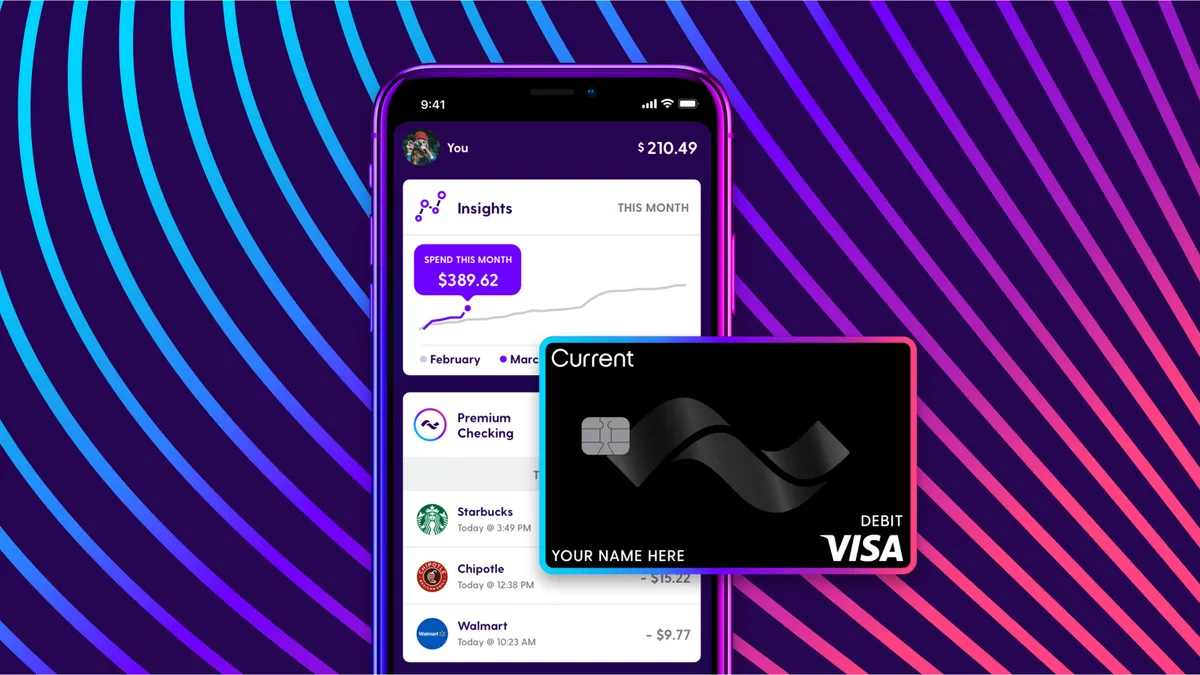

"We will continue to credit all accounts with stimulus transactions immediately as soon as we receive them over the coming weeks and months, so please continue to check your account balance in the app," the company said Friday.

New York-based Current says it has around 800,000 customers, many of whom live paycheck-to-paycheck while working jobs deemed "essential" during the pandemic.

"We've actually seen, from our customer base, lots of people who are actually working more than they ever have," said Adam Hadi, Current's vice president of marketing. "But of course, you have those who've lost their jobs, as well."

The bank's premium membership program allows customers to access paychecks up to two days early, a benefit the bank said it is extending to all members receiving stimulus checks in the wake of the pandemic.

"We credit that and get it in their pockets as soon as possible, which is an advantage that we have compared to traditional banks because they aren't incentivized to do that," Hadi said. “[Traditional banks] make money based on deposits, so they can't credit that ahead of time.

"We have a fundamentally different business," he added. "We aren't making money based on the amount of deposits we have, like a traditional bank."

Like many challenger banks, Current collects revenue on interchange fees, when customers spend their money, and deposits are held at its partner bank, Choice Bank.

Current isn't the only bank allowing customers early access to their stimulus funds.

San Francisco-based Chime began providing cash this month to select customers through its no-fee SpotMe feature, allowing users to overdraft on their accounts up to $1,200.

After first piloting the program for 1,000 customers, Chime expanded the program to 100,000 customers, but lowered the no-fee overdraft amount to $200.

Chime said the majority of the participants in the original test did not access the full $1,200. About 500 people took the offer, using $150 to $300 on average, Chime CEO Chris Britt told Forbes.

Oklahoma-based Citizens Bank of Edmond made a similar overdraft option available to customers last month in an attempt to expedite the government checks. CEO Jill Castilla announced in a tweet that the first wave of the stimulus checks were in customers’ accounts Monday.

About 45% of the stimulus money that's been issued to Current's customers has already been spent — mostly on essential items, such as gas and groceries, Hadi said.

Current said its peer-to-peer payments system, Current Pay, saw record usage Monday, but the bank declined to share metrics with Banking Dive.

"Our users are literally the first in the country to have received the stimulus checks, and that's really special," Hadi said. "Banks are always there when you have a lot of money. What banks are there for you when you don't? And that's where we've been, and I think our customers really appreciate that."