Credit Sesame acquired Canadian challenger bank Stack, as the credit and loans company looks to expand its new banking services internationally.

The deal has been in the works for eight months and will accelerate the fintech's expansion into digital banking, Adrian Nazari, CEO of Credit Sesame, told Banking Dive. Terms were not disclosed.

Credit Sesame said it plans to integrate its credit services with Stack's digital banking offering to bring cash and credit management to Canadian consumers this year.

"The goal is to fully integrate the brand and allow Stack in Canada to fully operate and offer what we offer in the U.S. to the Canadian market," Nazari said.

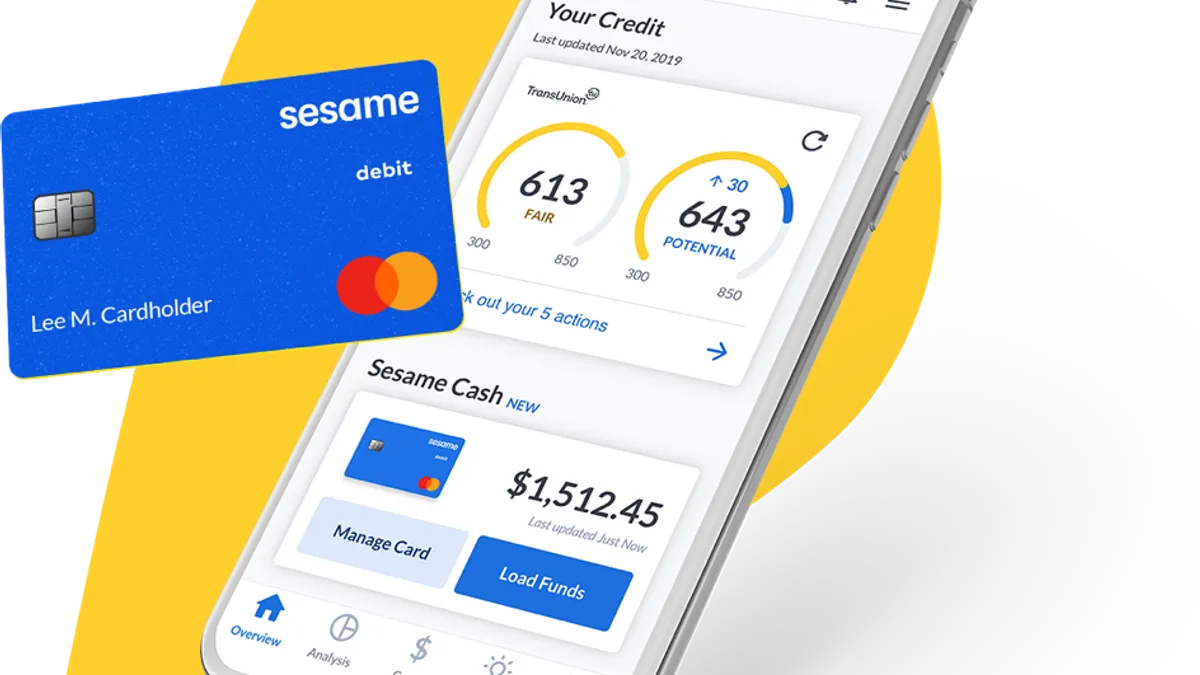

Stack began working with Credit Sesame last year to develop Sesame Cash. That product, which launched in March, marked Credit Sesame's first foray into the digital banking space.

"We wanted to offer a service that's not just another digital bank, but takes it to the next level with a financial platform that helps and works for the consumer and makes their cash work for their credit and their credit work for their cash," Nazari told Banking Dive in March.

Credit Sesame rolled out Sesame Cash to a limited number of existing customers in March and opened up general availability in mid-May.

More than 200,000 customers have signed up for Sesame Cash, and 62% of its 15 million members have expressed interest in the product, Nazari said.

Sesame Cash bank accounts will continue to be held by FDIC-insured Community Federal Savings Bank in the U.S., and Stack will maintain its relationship with its Canadian banking partner, Peoples Trust.

With the acquisition, former Stack CEO Miro Pavletic will head Credit Sesame's international expansion as general manager of Canadian and international business.

"The infrastructure we created allows us to expand beyond Canada to other parts of North America and Europe," Nazari said.

Pavletic, who launched Toronto-based Stack in 2018, said the challenger bank has 70,000 accounts. The company also white-labels its platform to 120 credit unions across Canada, which accounts for 4 million customers, Pavletic said.

"We expanded our business to essentially provide white-label, digital banking-in-a-box services for other players," Pavletic told Banking Dive. "But what we quickly found out, as we were onboarding our white-label clients, we saw a massive opportunity in terms of partnering with a large fintech that had an existing customer base. It allows us to accelerate all of our operations in terms of getting in as many hands as possible."

Nazari said he is encouraged by the response to Sesame Cash's soft launch, and thinks the product will exceed 1 million accounts by the end of the year.

"Our goal is not to necessarily be the traditional bank," he said. "Our goal is to maintain a great relationship with the consumer to change the way people manage their finances."

Sesame Cash includes early payday, real-time transaction notifications, a no-fee contactless debit card, direct deposit and the ability to freeze or unfreeze the debit card in-app. Customers can also receive cash when they improve their credit scores.