Rohit Chopra has left the Consumer Financial Protection Bureau, according to a letter he posted Saturday on the social media platform X.

“This letter confirms that my term as CFPB Director has concluded," Chopra wrote in a letter addressed to President Donald Trump. "I know the CFPB is ready to work with you and the next confirmed director, and we have devoted a great deal of energy to ensure continued success."

Trump designated Treasury Secretary Scott Bessent as the bureau’s interim chief, according to a statement posted on the agency’s website.

Bessent instructed CFPB staff Monday to halt the issuance of final rules, settlement of enforcement actions and participation in litigation proceedings, according to a memo seen by Bloomberg. The bureau has also been told to suspend the effective date of any final rules that have not yet gone into effect, the wire service reported. Only congressionally mandated regulations can move forward without Bessent’s approval, according to an email seen by Bloomberg Law.

“I look forward to working with the CFPB to advance President Trump’s agenda to lower costs for the American people and accelerate economic growth,” Bessent said Monday in the statement on the CFPB’s website.

Tapping Bessent to lead the bureau until the White House can nominate – and the Senate can confirm – a permanent figurehead would track with a Bloomberg reported Thursday that the Trump administration was considering placing the CFPB under the care of the Treasury Department or the Office of Management and Budget.

Trump made a similar move during his first term, naming then-OMB Director Mick Mulvaney as acting CFPB chief until the Senate confirmed Kathy Kraninger.

At least two high-profile banking trade groups expressed support for the CFPB changeover Monday.

“While we have always supported the CFPB’s consumer protection mission, we have disagreed with many actions the Bureau has taken in recent years that have exceeded its statutory authority, harmed our economy and imposed significant costs on American consumers,” American Bankers Association CEO Rob Nichols said in a statement Monday. “We urge Secretary Bessent to begin reversing the damage caused by these misguided regulatory actions and stand ready to support his efforts to chart a better course for the Bureau.”

Lindsey Johnson, CEO of the Consumer Bankers Association, said she looks forward to Trump’s permanent choice to lead the bureau, so “trust and durability” can be restored.

“There are a number of immediate actions Secretary Bessent can take to rescind the partisan policies the former CFPB Director has taken that adversely affect consumers, and we stand ready to work with him to reset the CFPB,” Johnson said.

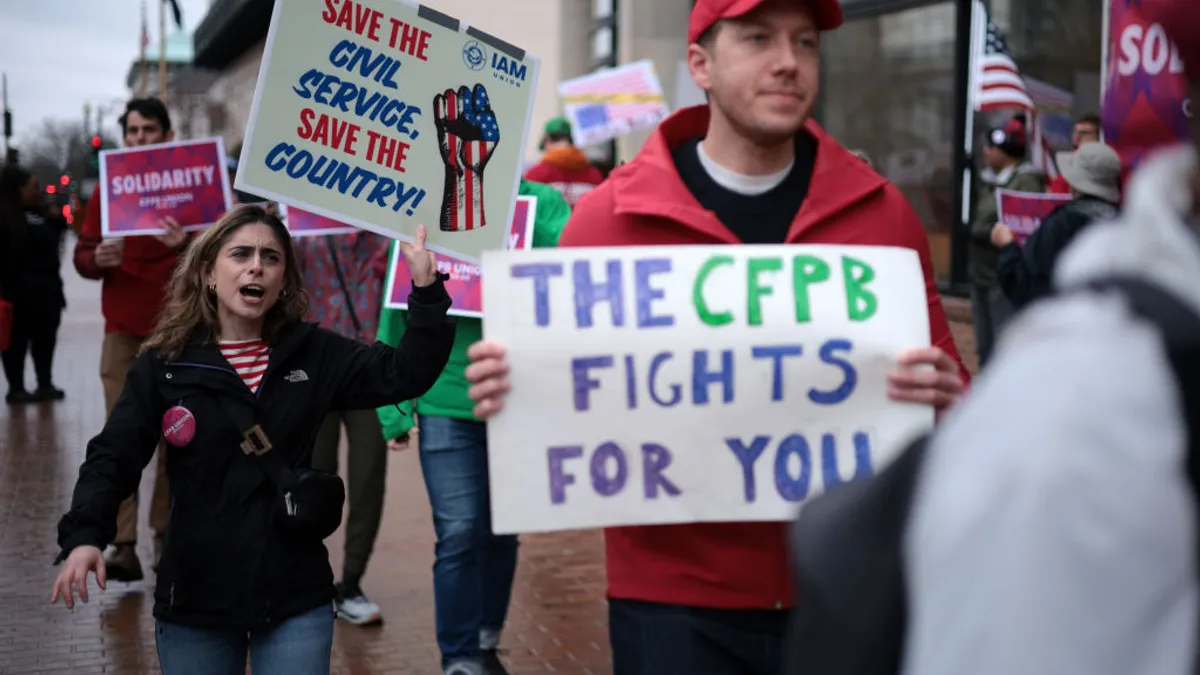

‘A fight on their hands’

Attorneys for the CFPB, in court paperwork Monday, characterized Chopra’s departure so: “The President removed the prior Director of the CFPB from his position.”

“It’s the executive’s decision and prerogative to see who they want in that role,” a White House official told CNN.

Chopra’s exit provoked a warning from two leading Democrats.

“President Trump campaigned on capping credit card interest rates at 10% and lowering costs for Americans,” Sen. Elizabeth Warren, D-MA, the Senate Banking Committee’s ranking member, said in a statement Saturday. “He needs a strong CFPB and a strong CFPB Director to do that. But if President Trump and Republicans decide to cower to Wall Street billionaires and destroy the agency, they will have a fight on their hands.”

Elon Musk, the Tesla and X CEO serving as a close adviser to Trump in November name-dropped the CFPB as an example of an agency that’s “duplicative” and should be “delete[d].”

Rep. Maxine Waters, D-CA, ranking member of the House Financial Services Committee, called Chopra’s departure “the end of an era of strong consumer protection and the beginning of a plan to end this important agency.”

“Make no mistake, today’s decision is the first step by Trump, his co-President Elon Musk, and their Republican allies in Congress to dismantle the agency entirely, leaving consumers with no place to turn to for help and no real watchdog to hold predatory lenders and other bad actors accountable,” Waters said in a statement Saturday. “Rest assured, my fellow Committee Democrats and I will continue to fight, as we have for more than 14 years, to defend the CFPB from Republican attacks and ensure they stay true to its mission of protecting hardworking Americans from financial institutions who continue to profit at their expense.”

Sen. Tim Scott, R-SC, chair of the Senate Banking Committee, last week teased a “blockbuster announcement sometime soon as relates to who will be over at the CFPB.”

“I’ve asked the administration, please fire the guy,” Scott said Tuesday, according to American Banker. “I think we’re going to be happy with the answer they give us and the person they give us as well.”

Chopra’s departure was widely expected – arguably sooner. After the November presidential election, many observers had predicted Trump would fire Chopra on “day one” of his term. Trump would have been within the law to do that. The Supreme Court ruled in 2020 that the CFPB director is an at-will employee. Former President Joe Biden asked for Kraninger’s resignation less than an hour after he’d been sworn in.

A ‘coup’ and a record settlement

Chopra’s exit prematurely ends a five-year term that was set to run through September 2026. He was never particularly popular among Republicans: The Senate approved him 50-48 in a party-line vote in 2021. And almost immediately, he made a splash in his secondary role as a board member at the Federal Deposit Insurance Corp. (Chopra’s departure Saturday from the CFPB means he’ll no longer serve at the FDIC, either.)

When the FDIC’s then-Chair, Jelena McWilliams, struck down Chopra’s request in December 2021 to include the results of a vote on bank merger policy in the agency’s official minutes, Chopra and then-FDIC board member Martin Gruenberg posted a joint review of bank merger policy on the CFPB’s website.

Chopra and Gruenberg claimed the FDIC board had voted to “launch a review of the agency’s Bank Merger Act policies” and begin a 60-day public comment period.

McWilliams asserted the agency had never approved the request for comment.

Then-Sen. Pat Toomey, R-PA, compared the rift to a failed “coup” at the FDIC. Nonetheless, McWilliams resigned three weeks later, and Biden tapped Gruenberg to lead the agency.

Chopra made a reputation as an aggressive justice-seeker at the CFPB. The agency, during his tenure, reached a record $3.7 billion settlement with Wells Fargo over actions the bank took throughout its infamous fake-accounts scandal.

The agency, under Chopra, continued to issue final rules and file lawsuits long after Trump’s return to the White House was set — and after other regulators had slowed such efforts. During his last months leading the CFPB, Chopra pushed a long-awaited open banking rule that would give consumers more control over their personal financial data. The bureau also pushed a drastic reduction in overdraft fees for banks and credit unions with $10 billion or more in assets.

In December, the CFPB sued JPMorgan Chase, Bank of America and Wells Fargo over what it saw as a failure to protect Zelle users from fraud. More recently, the bureau sued Capital One, accusing the bank of obscuring a higher-yield savings account from legacy customers. Capital One, highlighting that Trump at the time was less than a week from office, said it was “deeply disappointed to see the CFPB continue its recent pattern of filing eleventh hour lawsuits ahead of a change in administration.”

The CFPB’s future

Once Trump’s choice to lead the agency is in place, observers expect a weeks- or months-long review of actions taken under Chopra.

The future of the agency remains to be seen. The Supreme Court last year upheld the CFPB’s funding structure, in a case that had the potential to nullify the bureau altogether.

Still, Warren and Waters warned of continued efforts to dismantle the agency — especially in light of Musk’s social-media post and the billionaire’s ongoing review of government efficiency.

Sen. Ted Cruz, R-TX, reintroduced a bill Wednesday to defund the agency.

“The CFPB is an unelected, unaccountable bureaucratic agency that has imposed burdensome and harmful regulations on American businesses, banks and credit unions,” Cruz said in a prepared statement.

Chopra, in his Saturday letter, told Trump he hopes the CFPB “will continue to be a pillar of restoring and advancing economic liberty in America, and I wish you good luck in serving our great country.”

“With so much power concentrated in the hands of a few, agencies like the CFPB have never been more critical,” Chopra said.