Dive Brief:

- Credit reporting agencies are obligated to screen consumer credit reports for “junk data,” the Consumer Financial Protection Bureau (CFPB) said Thursday in guidance the agency said is aimed at ensuring consumer reporting companies comply with consumer financial protection law.

- The CFPB said junk or incorrect data in credit reports can spur consumers to be denied credit, housing or employment, or to pay more for credit. Examples include a child having a mortgage, or a credit report that reflects a debt incurred years before the person was born, the bureau said.

- The agency said the roughly 400,000 children in U.S. foster care are particularly susceptible to false credit data, because of a high rate of identity theft among the demographic.

Dive Insight:

The CFPB on Thursday said it receives more complaints about credit reporting than any other subject. Complaints about “incorrect information on your report” represented the largest share of credit or consumer reporting complaints submitted to the agency over the last six years, the CFPB said.

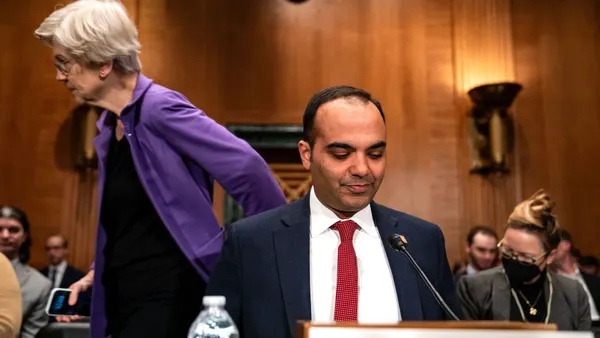

“When a credit report accuses someone of defaulting on a loan before they were born, this is nonsensical, junk data that should have never shown up in the first place,” CFPB Director Rohit Chopra said in a statement. “Consumer reporting companies have a clear obligation to use better procedures to screen for and eliminate conflicting information, or information that cannot be true.”

Children in foster care are disproportionately at a higher risk of being harmed by junk data because they often lack permanent addresses, and their personal information is frequently shared among numerous adults and agency databases, the bureau said.

“Consumer reporting companies have a legal requirement to follow reasonable procedures to assure maximum possible accuracy of information that they collect and report,” the agency said.

Companies must have policies and procedures to detect and remove inconsistencies and “obvious impossibilities” in credit data, the CFPB said.

For example, if an account included on a credit report includes a date that predates the consumer’s date of birth, that data cannot be accurate, the CFPB said.