The race to save 1,175 jobs at the Consumer Financial Protection Bureau on Feb. 14 – at least for now – came down to minutes, according to documents submitted Friday to a federal court in Washington.

A memo that Adam Martinez, the CFPB’s chief operating officer, sent to the Office of Personnel Management on Feb. 13 breaks down the number of employees the bureau aimed to cut, including 528 in supervision, 283 in enforcement and 170 in research.

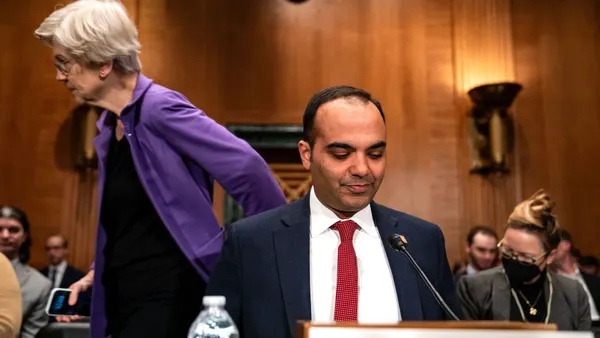

Martinez is set to testify Monday in the National Treasury Employees Union’s case against the bureau – specifically on how the agency has carried out its legally mandated functions throughout its monthlong stop-work order.

But Friday’s trove of documents included one time-stamped 12:34 p.m. Feb. 14 in which Martinez indicated the intention to put all CFPB staff on administrative leave starting that day and covering the 30-day notice period when employees transitioning out of the bureau would typically transfer their duties to a successor.

Such a move would give the agency’s leaders “flexibility … to call back staff to fulfill closeout duties such as enforcement cases.”

“If there are pockets of staff who we later determine do not need to be called back, we can immediately offboard them (i.e., terminate access) for the duration of the notice period,” Martinez wrote. “This will all be done this afternoon.”

A subsequent email to Martinez time-stamped 1:36 p.m. flagged a 2 p.m. hearing in the U.S. District Court for the District of Columbia, in which plaintiffs sought a temporary restraining order.

“While we will continue preparing, it's just a consideration when deciding when to send out the notices,” the sender, whose name is redacted, told Martinez.

A further email time-stamped 1:44 p.m. – again, with the sender’s name redacted – appeared to prompt OPM to hurry.

“Thanks for everything you're doing, but we need the last set of attachments now. We cannot wait until [close of business]. We also need an answer on the attached question about the guidance. Apologies, but we have been instructed we do not have until COB,” the sender wrote.

Another memo in Friday’s batch indicates OPM approved the CFPB’s list of employees to be reduced. And an internal CFPB memo indicates that the list, as of roughly 10 p.m. Feb. 14, was coded for separation with the effective date “TBD.”

The judge in the NTEU case, Amy Berman Jackson, ordered the CFPB on Feb. 14 not to terminate any agency employee except for cause related to job performance or conduct until a subsequent hearing March 3. Berman Jackson extended that order through Monday’s hearing.

Among the statutorily mandated work likely to be discussed Monday is how actively the CFPB has been monitoring its consumer complaint database since Acting Director Russ Vought took charge of the bureau. The CFPB’s website on Thursday began prominently displaying a mention of the process – after nearly a month with a 404 error across the top.

The CFPB’s former chief technologist – now a witness for the NTEU – told the court Feb. 27 that a 404 error message may spur consumers to abandon the site and obscure its visibility from search engine crawlers.

Three days earlier, Martinez, in a declaration to the court, said, “Operations related to the Consumer Complaint Database are continuing.”

“Contracts needed for work related to the Consumer Complaint Database have remained intact and operational,” Martinez said.

However, the CFPB on Feb. 12 canceled a contract with a vendor named Adaptus. The deal allowed documents submitted electronically to the CFPB’s complaint database to be scanned for viruses. However, removing that virus check prevented the complaints from being automatically forwarded to the companies that were required to respond, Bloomberg Law reported.

The CFPB restored the Adaptus contract on Feb. 20, according to the outlet.

In another declaration to the court March 2, Martinez said the CFPB’s chief legal officer, Mark Paoletta, activated the consumer response unit’s “critical statutory responsibilities.”

“As of February 27, 2025, members of the Escalated Case Management team, for example, are working,” Martinez said.

However, Matthew Pfaff, the chief of staff of the agency’s Office of Consumer Response – and a witness for the NTEU – said in his own declaration to the court March 2 that the escalated case management team was not operational.

Pfaff called Martinez’s characterization of Paoletta’s action “misleading,” and his declaration on the escalated case management team “blatantly false.”