Banking technology veteran Jim Gillespie, chief product officer at cash management firm Dragonfly Financial Technologies, has seen bankers do their work in silos for three decades.

“You'll have the deposit accounts and commercial lending as two silos, then you'll have investments as another silo … The ability to accept credit card payments is another silo,” he said. “Those often come from different vendor systems that run those [functions], or the bank has different systems run by different technology groups.”

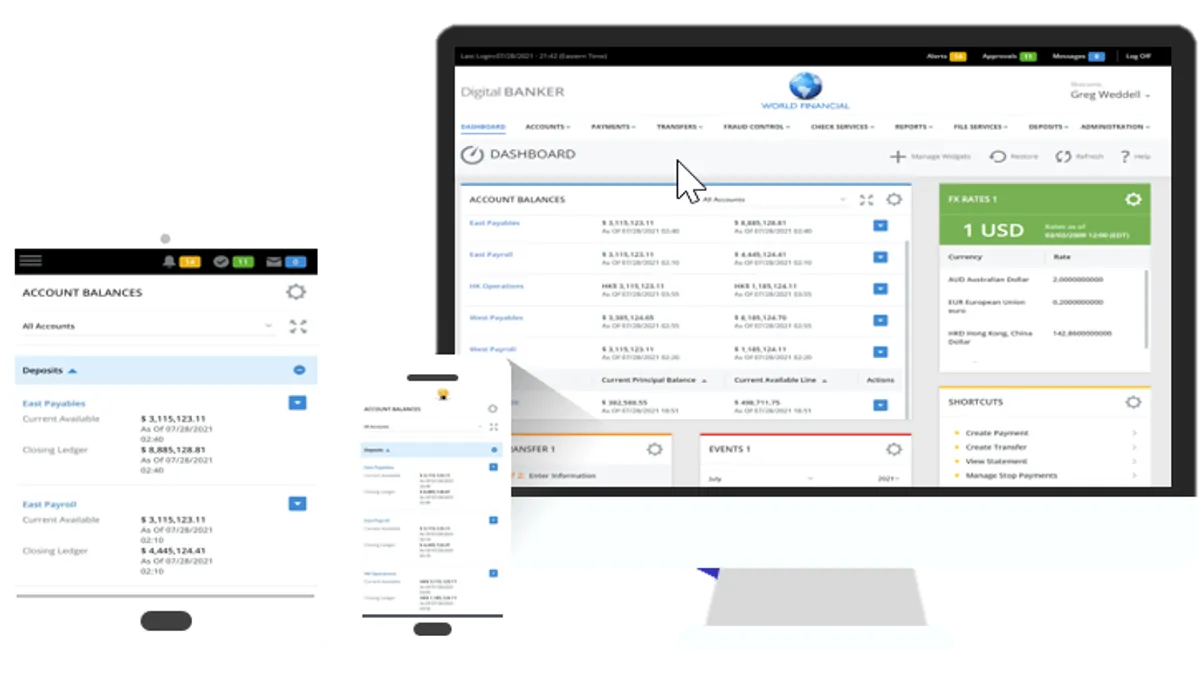

“Composable” banking, a flexible and technology-enabled approach to financial product delivery, offers a remedy to these issues, giving banks and their business customers the ability to show payments from credit card, ACH, and even FedNow all on one screen, thus allowing them to see their cash position now, historically, and what is known for the coming days.

Dragonfly’s Universal Online Banker product update last week offers the company’s current and future customers — big names like Truist and TD — composable banking capabilities, while also allowing these banks to choose from a number of implementation options depending on their size and the needs of their corporate clientele.

The options include Dragonfly Digital, for banks that want a fully featured user interface out of the box with end-to-end management; Dragonfly as a Service, for banks that want a headless platform — where the front end and back end of the platform are separated — and the ability to leverage APIs, UX components, and microservices from Dragonfly; and Dragonfly FinTech Integration Center, for banks that want to embed their brand into common fintech apps and make their own services accessible through these fintechs.

According to the company, UOB is the only composable banking platform on the market built with digital and embedded business banking needs in mind.

Christine Barry, head of banking and payments insights and advisory at Aite-Novarica Group in Houston, told Banking Dive that because commercial and corporate banking is more competitive than ever before, “banks must evolve their strategies and offerings to meet new customer needs and expectations, or risk attrition or disintermediation.”

Recent market research by Aite-Novarica Group shows that just 23% of finance and payment professionals at 300 U.S. midsize and large businesses feel their financial institution fully meets their cash management or payment capability needs from a functionality and usability standpoint.

To fill the gaps, six in 10 of the respondents are leveraging external fintech.

“Today’s customers expect tightly integrated, seamless experiences not only within the bank portal but also between the bank and the external systems they are leveraging. Composable banking provides banks with the necessary flexibility to address those expectations and expand their digital services to wherever their customers need them and within whichever systems they are using,” Barry said.

As user experience becomes a key differentiator for banks, more and more banks are “valu[ing] composable banking’s ability to let them run the solution headless and leverage their own unique UI,” Barry said.

Anne Boden, founder and soon-to-be former CEO of Starling Bank, told The Financial Brand this year that composable banking is the industry’s future.

“It enables financial institutions to offer customers a highly personalized and tailored experience, while also being able to iterate and improve at speed. With the right technology, banks can easily plug and play services, creating a truly customer-centric ecosystem,” Boden said.

On Dragonfly’s product, Jacob Heugly, a Zions Bank executive vice president, said, "As a long-standing customer of Dragonfly, we continue to be impressed with Universal Online Banker's capabilities and its ability to help us deliver new services to our commercial and small business banking customers. The upgrade process went exceptionally well, and we're pleased by Dragonfly's dedication to ensuring our customers did not experience any interruption of services."

UOB has been around since 2012, launched at the time by ACI Worldwide’s corporate online banking unit. ACI sold that entity to One Equity Partners for $100 million in 2022 and rebranded it Dragonfly. Chief Revenue Officer Carl Robinson said that the divestiture set now-Dragonfly on a path for growth.

“When we divested, one of the key aspects was retaining the [intellectual property], retaining the talent and the resources — and we were able to retain 100% of the people that we targeted to come to Dragonfly,” Robinson said.

To innovate, “we also brought in a lot of great minds at the senior level and throughout the company, even frontline, that are from other industries and have worked with fintechs and done cloud deployments before,” he said.

Dragonfly went from 235 workers, including employees and contractors, to 330.

Following the divestiture, Dragonfly also kept all its commercial banking customers, including four of the top 10 U.S. banks. A number of banks are also in the process of onboarding, Robinson said.

Both Gillespie and Robinson are company vets from prior to the divestiture, and what sets the team at Dragonfly apart, according to Gillespie, is their long history working in banking technology.

“A bank may find great composable technology from a vendor that has very little commercial banking experience, so they're really doing a ground up build, or they've got a great cash management feature function set that's in a highly coupled monolithic UI that's difficult and expensive to implement, to operate, and to maintain,” Gillespie said. “By adding the composable banking technologies to our existing platform, you’re really taking the user experience off, making it headless, and delivering these technologies. We're unique in that we have the out-of-the-box capabilities that get the customer to market quickest.”