BNY Mellon and financial empowerment fintech MoCaFi have partnered to bring payment options and banking services to unbanked and underbanked Americans, communities that make up 5.9 million and 18.7 million U.S. households, respectively.

The treasury services arm of the nation’s oldest bank will now provide federal, state and local governments, and corporate clients with a digital disbursement payment service, through its Vaia platform, which will allow the entities to distribute payments to unbanked individuals, or those without bank accounts.

This means governments will be able to pay out disaster relief payments digitally, in real time, to unbanked residents. BNY Mellon’s corporate clients will be able to pay their unbanked employees in real time, too.

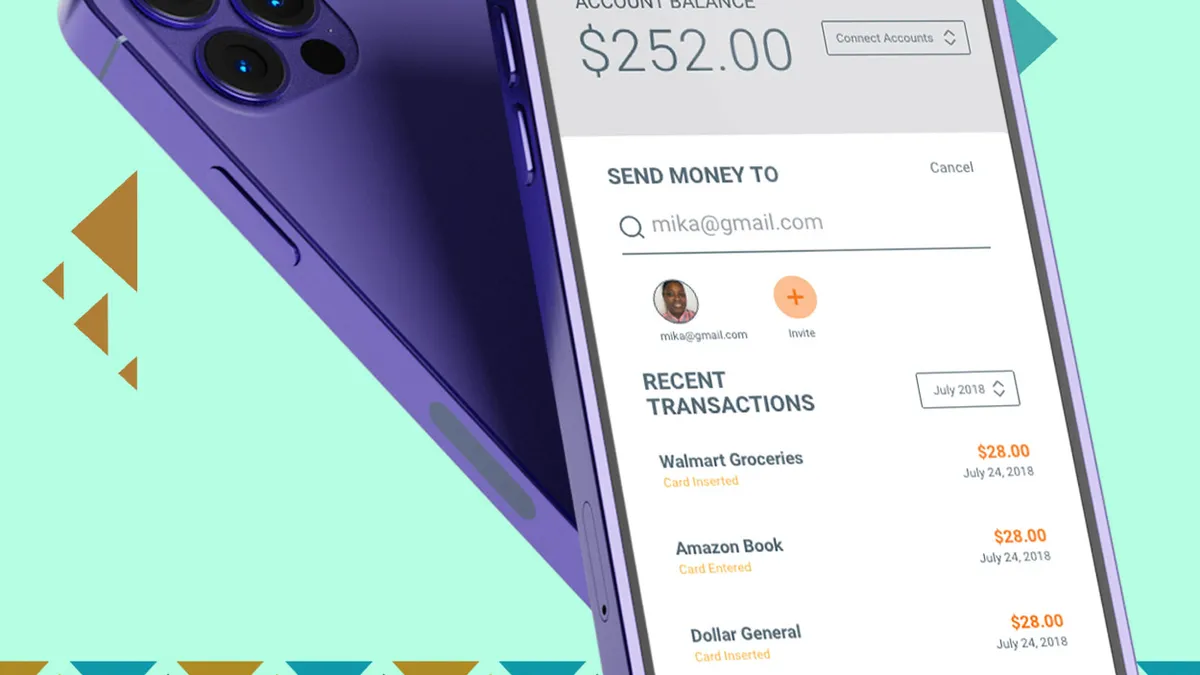

For example, if a government agency needs to distribute payments to residents, that agency would provide residents’ information to BNY Mellon’s Vaia platform, which would direct the agency to the solutions offered by MoCaFi. MoCaFi would then send each resident a text or email with an enrollment code informing them that an account has been created for them and instructing them to download the MoCaFi app. The resident would enter the enrollment code into the app and be presented with immediate access to their money in the form of a digital payment card — complete with a 16-digit account number, CVC code, and expiry date. An identical physical card would be sent to them in the mail, but the digital card would be available immediately.

“Once you have that pipe, [the agency] can put recurring payments in the account,” said Wole Coaxum, who founded MoCaFi in 2015 to bring the nation’s unbanked and underbanked into the folds of the financial system.

While unbanked means someone doesn’t have a checking or savings account, underbanked means they don’t have sufficient access to financial services, such as loans, beyond having an account.

For BNY Mellon’s corporate clients, Treasury Services CEO Jennifer Barker told Yahoo! News that a large grocery store, for example, might have a portion of unbanked workers — workers more likely to cash their checks at predatory check cashers, who charge a fee for each check cashed. These people would also be brought into the financial fold through the BNY Mellon-MoCaFi partnership.

Coaxum started the company as Mobility Capital Finance in 2015 to address the racial wealth gap, following the 2014 social uprising tied to the death of Ferguson, Missouri, resident Michael Brown, who was Black.

Black and Hispanic householders were significantly more likely to be unbanked than white households, the Federal Deposit Insurance Corp. found, with 11.3% and 9.3% of Black and Hispanic households respectively not having a bank account compared to 2.1% of white households.

When Brown died, Coaxum was the head of sales and segment for JPMorgan’s business banking arm.

“The death of Michael Brown reminded me of the footage I saw in the civil rights documentary ‘Eyes on the Prize,’ which really captured the uprising around 1967-68. I thought to myself, ‘It’s 2014 and the Black community is fighting the same battles as in 1967-68. I felt like I was very fortunate to have the training to address these issues, and that I wanted to get into the game,” he said.

“The social justice framework from the death of Michael Brown — it needed an economic agenda to go with the social justice agenda. I felt I could really use my time and resources to lean into the economic justice agenda,” he said. “I’d much rather in my life try to tackle a problem and fail than to look back and to have not even tried.”

Income and education also correlate to whether a household is unbanked, the FDIC report shows.

Households with an annual income of less than $15,000 are the most likely to be unbanked, at 19.8%, and the percentage of those unbanked changes drastically as household income goes up. For households making between $15,000 and $30,000 annually, 9.2% are unbanked. For households making $75,000 or more, just 0.6% are unbanked.

And while 6.8% of households with a high school diploma are unbanked, 19.2% of households with no high school diploma are — and for households with a college degree, that number goes down to 0.9%.

A potential BNY Mellon-MoCaFi partnership had been in the works since 2022. Engaging the unbanked and underbanked has long been a challenge for the government and business entities BNY Mellon serves, Carl Slabicki, the bank’s co-head of global payments, told Banking Dive via email.

“Given MoCaFi’s focus is to engage, enroll, facilitate payments and offer incremental financial services to those individuals, it was a ‘win-win’ for all collective stakeholders to pair BNY Mellon’s industry scale disbursements offering for government entities and businesses to pay and drive traffic to MoCaFi’s platform, to help further accelerate adoption and the ability for those individuals to safely receive their funds and bring them into the financial services eco-system through registration with MoCaFi,” Slabicki said.

The BNY partnership allows MoCaFi to play in a larger space and have a positive financial effect on more people — particularly, communities of color. But it isn’t the fintech’s breakthrough with one of the nation’s largest banks. MoCaFi inked a deal with Wells Fargo that allows users to access the bank’s ATMs for free. The fintech has also disbursed at least $100 million in guaranteed income, emergency rental assistance and other cash assistance programs.

MoCaFi made Forbes Fintech 50 and Fortune’s Impact 20 in 2021, and the company recently raised a $23.5 million Series B round. Coaxum said MoCaFi will use the funds to further its mission of helping underserved communities create wealth through better access to public, private and social capital.