Bluevine on Wednesday announced the launch of Bluevine Premier, a high-yield checking account for small-business owners that offers a 4.25% annual percentage rate on balances up to $3 million.

The offering pairs a high return with cash flow flexibility, two features in strong demand among small-business owners, said Charles Amadon, Bluevine’s senior vice president and general manager of banking.

“While many of them would love to earn a high yield on their cash, maintaining cash flow simplicity is a higher priority for them,” Amadon said.

Bluevine Premier places no constraints on business owners’ ability to move their funds or the number of transfers in and out, said Amadon, who equated the plan to a “checking account that earns savings-level interest on your money.”

“The simplicity of a checking account, from a cash-flow standpoint, with the interest yield that we're providing, we think that's a winning combination. And we know it is because we talk to customers about how they would feel about it. And they tell us in very strong terms that this would be game changing for them,” he said. “And it's something that's missing in the markets.”

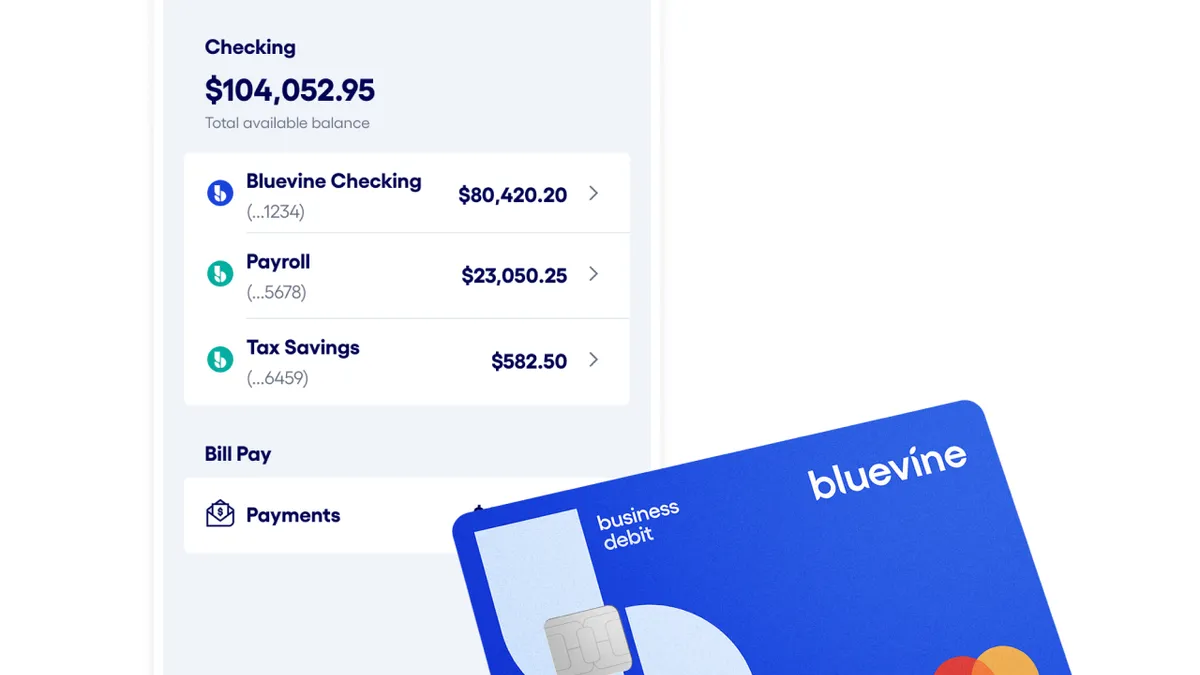

Bluevine Premier is free for customers who maintain a $100,000 minimum average daily balance across their Bluevine business checking account and sub-accounts and spend at least $5,000 per month on their Bluevine debit card, according to a release. Otherwise, Bluevine charges $95 a month for the service.

Premier customers also receive 50% off most payment fees, such as wires and same day ACH, the fintech said.

Bluevine is launching the offering amid strong momentum in the business banking market, Amadon said.

“We're seeing more and more folks come to us who are very established, with large deposit balances. They're not going to, on the flip of a card, move their entire banking business. They’re cautious, they're careful and they're thoughtful about exploring our offering and doing the ROI math on what the differences would be,” he said.

Amadon anticipates the higher yield will further entice small-business owners to ditch traditional branch-based banking, claiming small-business owners are already flocking to the fintech from some of the largest institutions.

“These folks are the hardest to win in the market, and some of the most important ones in the market because they have the most banking pain. They have the most challenges with traditional branch-based banking in terms of the time they're spending and the effort it takes to manage the fees that they're paying,” said Amadon, who declined to share the number of accounts Bluevine has garnered since launching. "Long-term, strategically, we want to be the business bank that business owners love, regardless of size.”

Bluevine launched in 2013 as a small-business lender and began offering deposit accounts in 2020. The accounts, which the fintech offers in partnership with Coastal Community Bank, are closing in on $1 billion in deposits, a Bluevine spokesperson said.