Dive Brief:

-

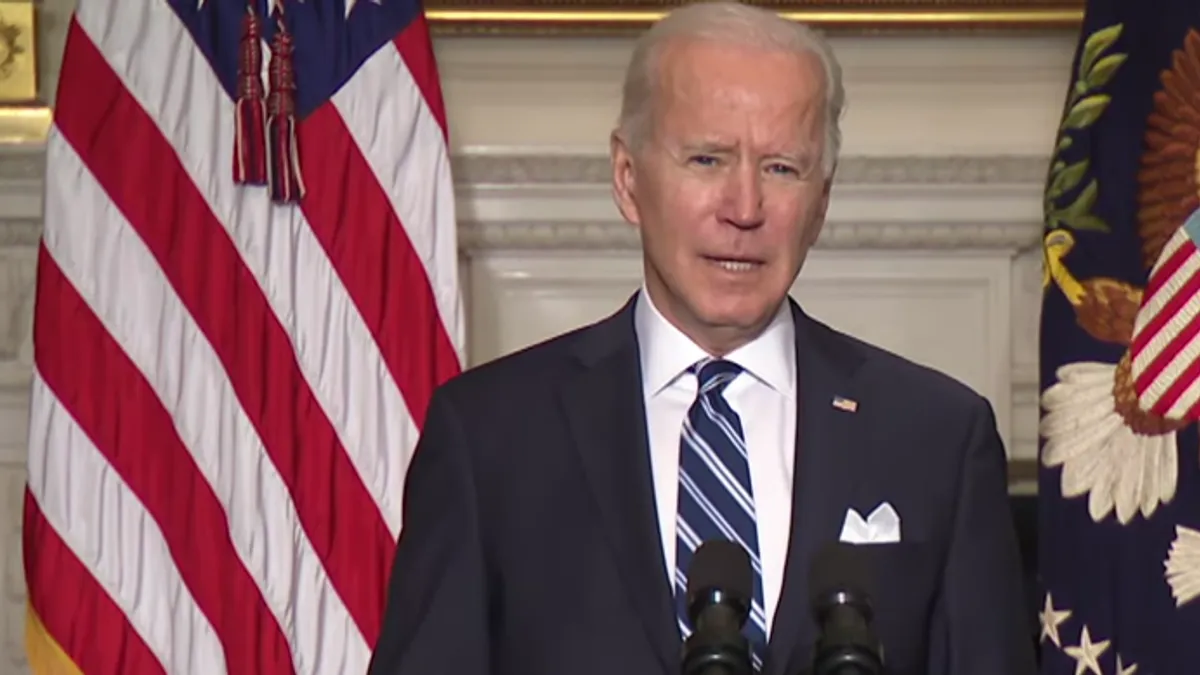

President Joe Biden issued a slew of executive orders Friday aimed at promoting U.S. competition and cracking down on anticompetitive practices, according to a statement released by the White House. Among those orders are two measures that would provide more scrutiny of bank mergers and give consumers greater control over their financial data.

-

One order requires the Department of Justice (DOJ), the Federal Reserve, the Federal Deposit Insurance Corp. (FDIC), and the Office of the Comptroller of the Currency (OCC) to update guidelines "to provide more robust scrutiny of [bank] mergers." Another "encourages the Consumer Financial Protection Bureau (CFPB) to issue rules allowing customers to download their banking data and take it with them."

-

The administration’s financial services-related orders are among 72 actions and recommendations that take aim at corporate consolidation in an effort to boost competition in several sectors, including healthcare, technology and transportation.

Dive Insight:

The Biden administration pointed to "excessive consolidation" from bank mergers and the impact rural and nonwhite-majority communities have felt as a reason more scrutiny is needed regarding financial services M&A.

"Though subject to federal review, federal agencies have not formally denied a bank merger application in more than 15 years," the administration said, citing a paper by Jeremy Kress, a University of Michigan professor who previously worked on bank merger oversight at the Federal Reserve.

"Excessive consolidation raises costs for consumers, restricts credit for small businesses, and harms low-income communities," the administration said.

A source with knowledge of the orders told Reuters "a rash of bank closures across the United States" has led to "a crisis of competition."

"[W]e’re dealing with the bad effects for a lot of people, and it’s also hard to switch options," the source told the wire service.

The U.S. has lost around 10,000 banks, or 70%, over the past 20 years, according to data from the Federal Financial Institutions Examination Council and the Federal Reserve Bank of St. Louis.

The Biden administration’s plan to encourage financial data sharing in the banking industry is welcome news to fintechs and proponents of open banking.

The debate over who owns customers’ financial data has pitted some fintech startups against some of the largest financial institutions in the past year, as data aggregators’ screen-scraping practices have been blocked by some banks citing privacy concerns.

Some aggregators, such as Plaid and Finicity, use the practice to connect consumer accounts to fintechs such as peer-to-peer (P2P) payment platform Venmo and robo-adviser Betterment.

JPMorgan Chase and PNC have blocked some aggregators from accessing passwords through screen scraping in favor of entering into data access agreements with fintechs through the use of application programming interfaces (APIs), a tokenized method that many banks say is more secure.

But not all banks have the technology budget to build their own APIs, a disparity that perpetuates a lack of consumer choice, fintechs have argued.

In October, the CFPB issued an advance notice of proposed rulemaking (ANPR), which addresses Section 1033 of the Dodd-Frank Act, a statute that gives consumers the right to access their financial information held by a bank.

The White House hopes Friday’s executive orders will encourage the agency to push ahead with those changes, a source told Reuters.

Richard Prior, CEO of the Financial Data and Technology Association (FDATA), a global trade group that advocates for opening banking, applauded the order.

"This is potentially huge news and an outcome that has long been fought for by FDATA North America and its diverse community of member companies," he wrote in a LinkedIn post. "There are certainly many subsequent critical pieces of the puzzle that will need to follow for a healthy and successful Open Banking/Open Finance ecosystem, but a defined consumer data right is at the heart of what is needed to drive this. Examples abound in markets around the world, at different stages of maturity and implementation. It will be truly an historic moment in the journey for the U.S. to see this step taken."

Meanwhile, the Bank Policy Institute (BPI) appeared to take issue with the Biden administration’s assertion that the banking industry needs more scrutiny to prevent anticompetitive practices and consolidation.

"By any analysis, banking is among the most competitive, least concentrated industries in America, as anyone who has shopped for a credit card, mortgage or deposit account knows," BPI President and CEO Greg Baer said in a statement. "Moreover, banks continue to lose business to unregulated FinTechs or government-sponsored enterprises, whose presence in the market current DoJ guidelines inexplicably ignore in assessing market competition. Those guidelines should be amended to reflect the underlying law."