With its brick exterior and teller windows that retain their wrought iron bars, a trip to Barwick Bank in Georgia is like a journey back in time.

Until recently, operations at the $22 million-asset bank — the state's smallest — had hardly changed since its establishment in 1907. Barwick Bank used ledger books instead of electronic tools to track transactions. It had no debit cards, website or modern technology infrastructure, and many of its 80 customers did business with the bank because their families had a long-standing history with it.

But the bank, which serves a community of less than 400 people, realized it needs to adapt to a changing market. As FDIC Chair Jelena McWilliams has highlighted, community banks face challenges from consolidation, economies of scale and competition, and innovation is necessary for their survival.

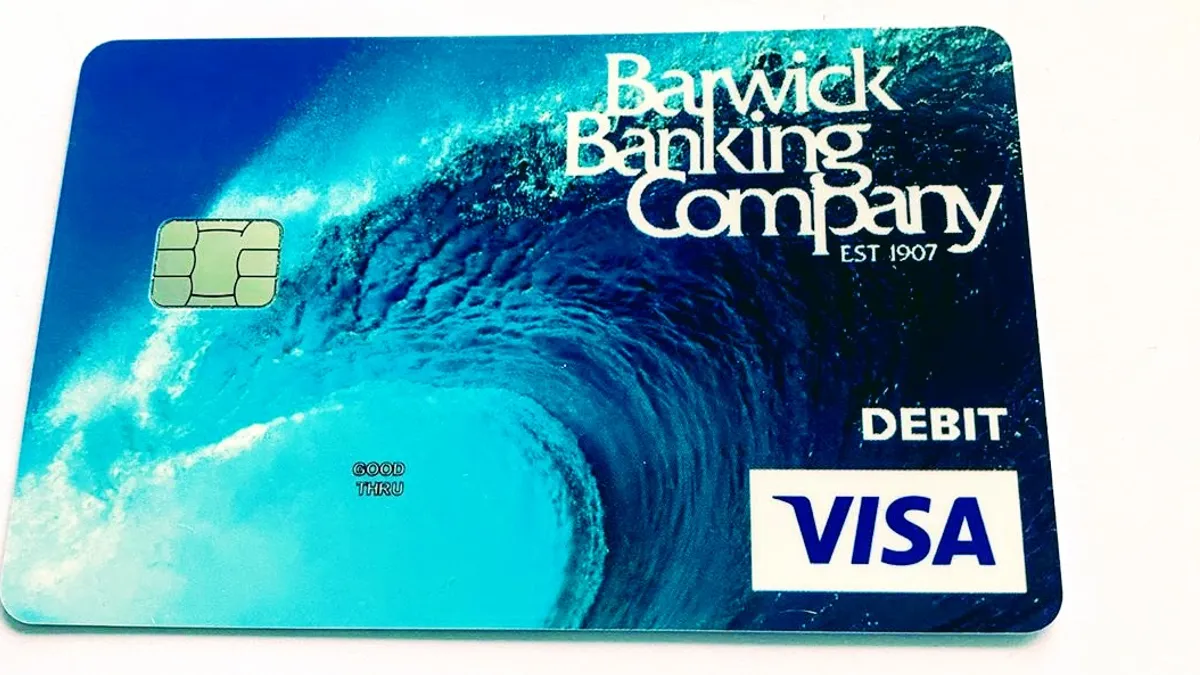

With its eyes on the future, the bank this week launched a digital product suite, with debit cards and online banking based on Finastra's Fusion Phoenix core operating system. The bank will keep its Barwick branch open and plans to expand into Florida next year. The goal will be to provide consumer and business banking offerings typical of larger institutions, with a personal touch.

"It really is an underserved community, and we feel we want to keep serving that community and keep it operating, but it also allows us a platform to move into St. Augustine and Daytona Beach next year," CEO Jim Bange told Banking Dive. "[Customers] are going to be able to have all the products and services that they would find at a Bank of America or a larger bank, but they'll still be able to bank with their community bank."

Bange and a group of investors acquired a controlling interest in the bank in December 2019 in a deal worth $2.5 million. The bank's former CEO, Fred Jones, who held the post since 1979, was looking to retire and had no succession plan. Bange said he and his partners saw the deal as an opportunity to use the bank's charter to expand its footprint. Jones remains on Barwick's board.

"An easier route to take than starting a de novo is to purchase an existing charter," said Bange, who has prior experience building a new bank. He founded Reunion Bank of Florida in 2008. After growing its assets to $375 million, he sold it to National Bank of Commerce in 2015, which was acquired by CenterState Bank in 2019.

Asked whether he intends to sell Barwick Bank after resurrecting it, Bange suggested it's a long game. His goals include growing the customer base, expanding to new geographies and ultimately delivering value to shareholders.

"It's more of a longer-term investment versus somebody going in and ‘flipping,'" he said. "It's very difficult these days to do that."

Digital banking with a human touch

The shift toward digitizing Barwick Bank's operations was carried out to grow the bank's customer and asset numbers, as well as encourage existing customers to consolidate their banking relationships with one institution, the bank said. The company also plans to offer a range of consumer and business banking products, with capabilities to carry out transactions both digitally and in person.

For business customers, the bank plans to continue to offer small-business and agricultural loans, in keeping with the needs of residents of Barwick, surrounding areas and target markets in Florida. Barwick Bank delivered 14 Paycheck Protection Program loans in recent months, Bange said.

The pandemic has pushed the momentum toward digital, as customers feel less inclined to visit branches.

"Not having a digital presence hurt us, because otherwise we would have been able to say 'You could go online and take care of it', but we didn't have that option," Bange said.

In deciding on a core solution, the bank said it evaluated options from Finastra, FIS, Fiserv and Jack Henry based on a series of user experience factors that included ease of account opening. Bange had previously used Finastra's Fusion Phoenix offering to support Reunion Bank of Florida's operations. Other community banks that have integrated with that core over the past year include The Peoples Community Bank, Seattle Bank and First National Bank and Trust.

"You have a single platform that can serve both retail and commercial, and Barwick is a great example of that," said John Weinkowitz, Finastra's general manager of retail and head of product strategy for community markets. "It's in the cloud, so it can scale, and on Azure specifically, and the architecture is all open [application programming interfaces]."

Despite the shift toward digital transactions, Barwick Bank's customer acquisition strategy will still focus on communicating and nurturing relationships with business owners.

"It's more-touch, high-touch marketing, and not just putting up a Facebook page and sending out ads," Bange said.

Even though he plans an expansion into Florida, Bange doesn't foresee a push to grow Barwick's brand into a national one, preferring to keep the bank's community orientation intact.

The technical challenge

With the rise of easily deployable "digital bank in a box" solutions, it's become easier, and more cost effective, than ever to build a digital bank from the ground up. In recent years, core providers, including Jack Henry and FIS, have rolled out solutions that allow a company to stand up a digital bank in 90 days.

Going to a modern core from no digital infrastructure is easier than upgrading a legacy system, Bange said. But while digitizing infrastructure has become more accessible, the rollout will likely involve smoothing over some bumps along the way, analysts said.

"Although this bank is getting some efficiency by modernizing to a digital operating system, which is great, they're still going to have to prove that the technology is safe and sound in the eyes of regulators," said Lane Martin, a partner at Capco. "There's a lot of ways to get there over time, but it's not necessarily a huge slam dunk."

The bank will likely need to test what resonates with customers from a user experience perspective, and ensure its support mechanisms can handle questions when they arise, said Matthew Markham, a fellow Capco partner.

For now, Barwick Bank's priority is ensuring a smooth transition to digital. The bank's team has quadrupled to 12 since the acquisition, has been trained to use the new system, and is offering in-person and phone support to customers. The bank is also in the midst of a $17 million capital raise — which it expects will close by the end of the year — to support its operations and expansion.

Bange said he is open to fintech partnerships after Barwick's digital transformation and expansion plans get off the ground.

Barwick can differentiate by emphasizing its relationship banking ethos, Capco's Martin said.

"There's sticking power for the community bank within people's hearts," he said. "People feel good about doing their banking locally and helping their neighbors out, and I don't think that trend is necessarily going away."