Dive Brief:

- Bank of America has asked the Small Business Administration (SBA) to pull the data it released this month regarding Paycheck Protection Program (PPP) loans, correct it and re-issue it, a person with direct knowledge of the matter told Reuters.

- Additionally, 30 Democratic lawmakers laid out a number of "grave concerns" about PPP data errors in a letter Monday to the SBA, asking the agency to "rectify these issues promptly."

- Hundreds of thousands of applications were found to have listed an incorrect number of jobs retained by the loans. Another data field — congressional district — was listed incorrectly for roughly 226,000 borrowers.

Dive Insight:

The letter comes as lawmakers are negotiating a new infusion of PPP funds. A Republican plan unveiled Monday would earmark $190 billion for the program through the end of the year. That includes $130 billion in previously set-aside money that hasn’t been used. The program as it stands is set to expire Aug. 8.

"Time is of the essence," Rep. Jason Crow, D-CO, told Reuters, adding he sought a meeting with SBA staff to discuss how and when the data would be corrected.

The lawmakers asked the SBA to explain its "jobs retained" figures and whether the agency made efforts to verify the data independently.

More than 554,000 applications list zero in the "jobs retained" field, according to a Bloomberg analysis of about 4.9 million filings. The field is blank for another 324,122. Seven loans list negative job numbers.

"Data covering the number of jobs retained per loan and the borrower's congressional district has proved to be largely erroneous, casting shadows on the veracity, quality, and reliability of other loan data," the lawmakers wrote.

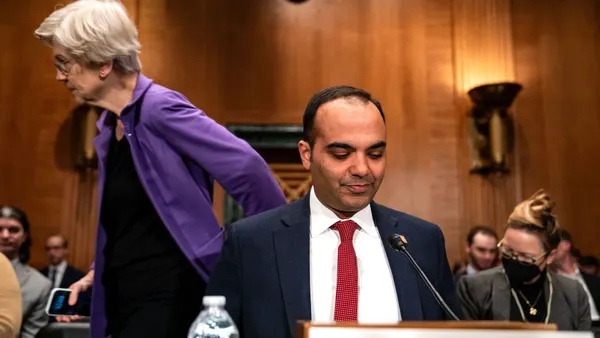

An SBA spokesperson Tuesday did not comment to Reuters, but SBA Administrator Jovita Carranza said during a hearing this month that she was willing to address errors.

The disclosure of data regarding loans of $150,000 or more was meant to satisfy growing concern over a perceived lack of transparency in the PPP process.

Bank of America — the most prolific PPP lender, facilitating 334,761 loans as of June 30 — may see itself as the bank with the most to lose if the program is seen as less than trustworthy. Borrowers' loans will be forgiven if they can prove they spent 60% or more of the PPP funds on payroll. A spokesman for the bank declined to comment Tuesday.

In all, about 20% of PPP loan applications contain flawed job numbers, Bloomberg estimated, leaving in doubt the government’s claims that PPP supported 51.1 million jobs.

"We should know where the money went, how many jobs were saved, and right now with the data, we don’t have that ability to say with any certainty," Kyle Herrig, president of Accountable.US, told the wire service.