The team behind Bank of America’s digital banking platform for businesses is concentrating on hastening onboarding and increasing personalization to sharpen client experience.

That’s according to Kristin Gemma, head of CashPro communication, products and strategy at the bank. CashPro handles treasury and payment needs for about 40,000 companies, ranging from small businesses to global corporates.

“We’re really thinking about, how do we improve onboarding for clients, so that it doesn’t take a long time to get set up with the bank?” Gemma said during a recent interview. She manages CashPro’s communications process team, which conveys platform changes and developments to clients, and provides customers with thought leadership and information on the payments landscape.

Finance professionals, corporate treasurers, accounts payable and receivable staff and C-suite executives use CashPro to manage their treasury, trade, credit and investments. That includes making payment approvals or decisions related to fraud, or depositing checks. More than $1 trillion in payments were made through CashPro’s app last year, a 25% year-over-year jump, as businesses favor mobile capabilities.

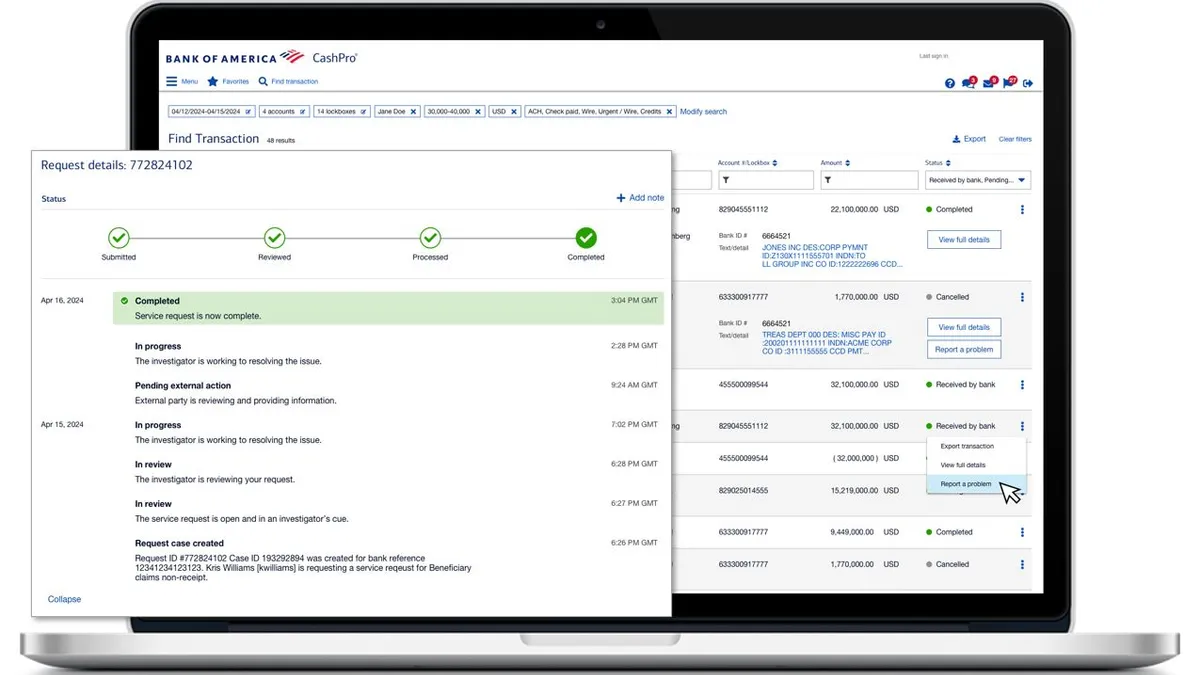

Last year, the Charlotte, North Carolina-based lender added a function that allows CashPro users to launch an inquiry into the status of a transaction within the platform, part of the bank’s continuous effort to boost its digital banking capabilities so businesses can do more online instead of calling or emailing for assistance.

Currently, clients spend time talking to bankers or customer service employees, sharing information over the phone and via email, which the bank envisions moving to the CashPro platform, Gemma said.

“We can all get a transparent view of what’s happening, the client can feel very comfortable exchanging information with us in the platform, because they’re authenticated,” Gemma said.

To that end, the CashPro team is working to roll out more functionality “to speed up that time to onboard and also take out a lot of the noise,” Gemma said. The team has tweaked CashPro’s application programming interfaces – which allow clients to access the platform through a third party such as a treasury management system or enterprise resource planning platform – to hasten client onboarding time.

Later this year, the bank aims to add a new credit card enrollment option to the platform, Gemma said. That will allow certain business banking and commercial banking clients to apply for a commercial card through CashPro, similar to what the bank already does on the consumer side.

“It’s bringing more of that consumer experience into Cash Pro,” Gemma said. She declined to specify when the bank plans to add that capability.

CashPro continues to be an area of focus for the bank, which spends $13 billion annually on technology, as of this year; of that amount, $4 billion goes toward new technology initiatives, a bank spokesperson said. Gemma declined to share specific investment numbers for CashPro.

Bank of America also seeks to step up personalization for its CashPro clients, she said, which is likely to make it easier to draw their attention to changes or functions that might benefit them.

“Our clients are getting so much information now – we all are, right? – it can be hard to cut out the noise and understand what is truly impactful,” Gemma said. “We do certainly see that with clients, and it takes multiple tries, in some cases, to get them to take advantage of a new capability that we know will help them.”

“The more relevant we can make our communications to them, the more likely it is that they’ll actually be able to pay attention to it,” Gemma added.

Gemma’s team works to educate clients on how they can use CashPro, because some customers are eager to be early adopters and immediately try new functions, but others need to be informed answers to certain questions could be obtained faster through CashPro’s chat function, which is powered by BofA’s virtual financial assistant Erica. Erica has been able to handle about 40% of client inquiries in CashPro’s chat function, Gemma said.

The team is also doubling down on data intelligence, to give customers proactive notifications about potential actions, she said. Since a digital tool called Insights was rolled out, the bank has seen strong client adoption, “where they actually are taking steps that we recommend that they take,” she said.

Recently, for companies whose users had a payment approval that exceeded average amounts, CashPro issued a notification suggesting limits be reviewed. In response, about 1,000 users took action to lower payment approval limits, Gemma said.

“We will be doing more personalized and proactive pushes of insights like this throughout the year,” Gemma said. Leveraging data to help clients protect themselves remains a “top focus area.”