Dive Brief:

-

Digital bank Azlo launched Azlo Pro, a subscription-based banking service, on Tuesday, as the entrepreneur-focused neobank says it is seeing a surge in new account openings amid the coronavirus pandemic.

-

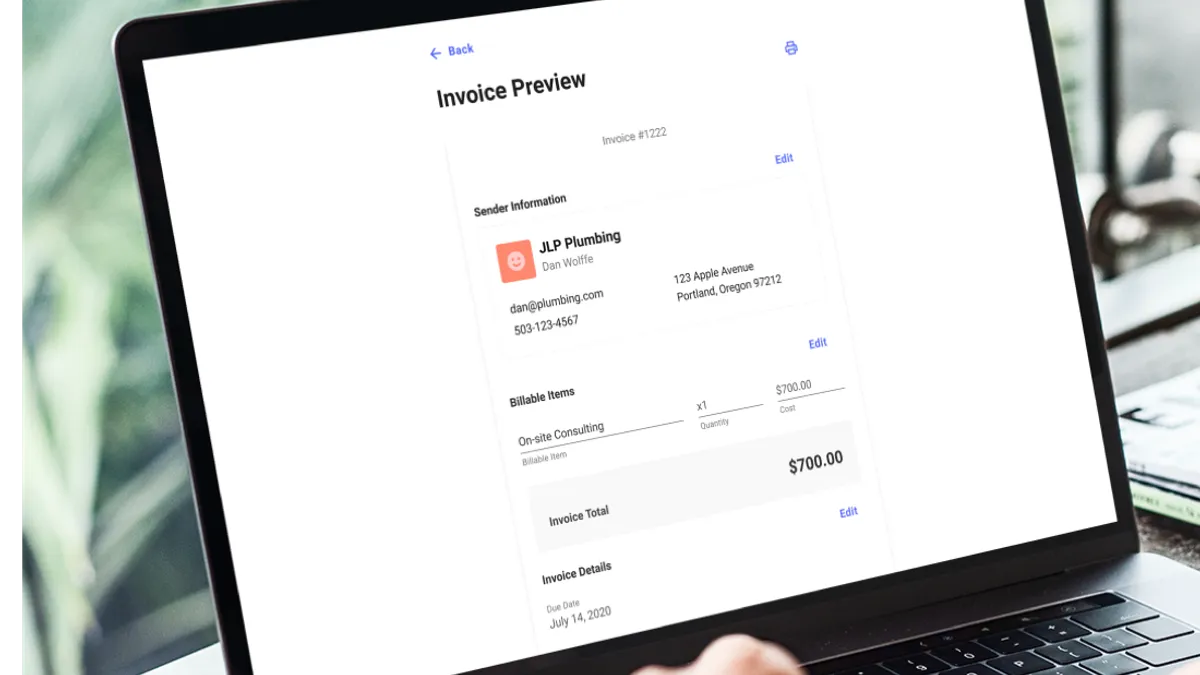

The subscription service, which costs $10 a month, bundles Azlo's existing features, such as invoicing, with new tools that include automated budgeting for payroll and taxes.

-

"We've seen a real growth and tailwind resulting from COVID," said Azlo CEO Cameron Peake. "With our customer base, we're seeing a lot more smaller and newer companies launch that don't have dedicated CFOs or specialization within their businesses. What Pro does is it helps automate a lot of those back-office tasks that you may not know about or may not have time to do."

Dive Insight:

The subscription-based account is the main thrust of revenue diversification Azlo is introducing this year, Peake said.

Peake told Banking Dive in December the company was exploring other ways to generate revenue outside of holding deposits and debit card interchange fees.

Azlo's free bank account, however, will always be available, Peake said.

"We're always going to maintain a fee-free base account," she said. "It's really important to our ethos and also really important if you're a newer company. We want to make sure that you can have a dedicated business bank account that's great for you.

"But we're also really invested in creating these higher-value, automated features for companies that do want to invest beyond that core account," Peake added. "Pro is that first step into that foray, and we will continue to invest in that over the next months and years."

The challenge with introducing Azlo Pro, Peake said, will be in getting customers to make the mental shift needed to embrace a new subscription banking service.

"It's not standard to have a subscription fee associated with your bank," Peake said. "But what is standard, is having a monthly account maintenance fee that's just kind of tacked on. One of the reasons Azlo was started in the first place was to level the playing field for small businesses. What we saw was that they were subject to high monthly fees and there weren't accounts created for them. There wasn't a real entry point that created a lot of value for a small-business owner, with respect to banking."

Peake said she thinks the industry will see more challenger banks adopt subscription-based models.

"As you look at neobanks and new fintechs that grow up more in the tech side as opposed to the fin side, that [software-as-a-service] model is a known quantity on the tech side. And I think, myself included, there's a real aversion to just charging for something like a monthly fee because it's how it's been done or because you can do it," Peake said. "I think tech shows more of a proclivity for an actual value exchange there. So I absolutely expect that [subscription model] to grow."

Other challenger banks that provide subscription-based banking services include Houston-based Majority, which targets the immigrant market; NorthOne, which caters to small businesses; and U.K.-based Revolut, which launched a premium account in 2017.

Azlo offers Federal Deposit Insurance Corp.-insured accounts through its relationship with BBVA, its investor and banking partner.