Aspiration has spun off its consumer financial services brand into a separate standalone company as demand for sustainable financial services rises, the fintech announced last month.

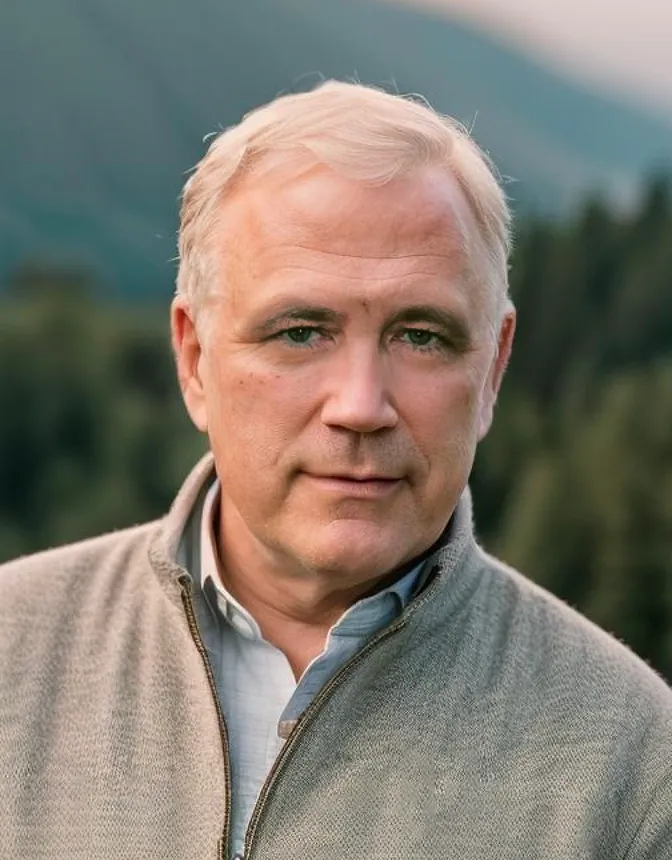

Tim Newell, who previously led Aspiration’s consumer fintech unit while he was Aspiration Partners' chief operating officer, reached an agreement with the firm to spin out that division. He takes the helm of the new neobank, which continues to operate under the Aspiration brand name. Newell did not disclose the purchase price, saying only, “we were able to reach an agreement that both sides felt good about,” Newell told Banking Dive in an email.

Newell and his team spent more than a year restructuring Aspiration’s consumer business to improve its economic performance and prepare it to function as a standalone company. The overhaul reduced operating costs, improved the unit economics of the products, and streamlined operations, resulting in a nearly 70% reduction in run-rate operating expenses — a feat necessary to secure the long-term financial health of the business, he said.

“During the last ten years, Aspiration had invested in building a brand focused on providing consumers with access to climate-friendly financial products. Over the last few years, however, Aspiration’s parent company has shifted its focus to investing in global carbon markets,” Newell said. “I saw an opportunity to spin out Aspiration’s consumer division to build a standalone financial services company serving climate-conscious consumers — a large and growing consumer segment.”

The neobank provides various spending, saving and investment solutions for individual consumers and families, and plans to expand its climate-friendly product offerings to include banking, credit, lending, investment and insurance products.

The spin-off was a smooth one, according to Newell. It didn’t interrupt Aspiration’s operations for consumers, who had consistent service and access to their accounts throughout.

“We will spend the next few quarters strengthening our sustainability features and making some changes to our core products to improve their value and enhance the customer experience,” he said. “Over the next year, we expect to begin introducing additional financial products for our customers — including credit cards, lending products, and additional climate-friendly investment products.”

Founded in 2023 by Newell, Mission Financial Partners will serve as the operating company for the Aspiration brand.

According to Newell, nearly 50 million consumers are climate-conscious, meaning they seek products and services that can have a positive impact on the climate, so he sees a growth opportunity for Aspiration. Since the Paris Agreement was adopted in 2016, fossil fuel financing from the world’s 60 largest banks has totaled $5.5 trillion, with $669 billion in fossil fuel financing in 2022 alone, according to a Banking on Climate Chaos report last year.

A study released by consulting firm McKinsey last year noted that nearly 40% of U.S. consumers showed interest in enrolling in a climate-linked financial product.

Aspiration Partners had been investing in global carbon markets, thereby operating two vastly different businesses, Newell said. Further, changes in the macroeconomic environment made it challenging for the neobank to secure the necessary capital to continue operations and grow the consumer business, he noted.

“It was clear pretty early on that a spin-off of Aspiration’s consumer business was likely the right strategic step. The real question was whether that should come through a sale to another financial services company, or through a spin-off into a standalone business,” Newell said.

Spinning off the business helps Newell jumpstart the launch of a new financial services company leveraging an existing customer base and a large investment already made in the brand, he said.

Aspiration offers banking services through Coastal Community Bank. But Newell managed to convert the neobank’s customer accounts from broker dealer cash management accounts to checking and savings accounts, which will offer more product flexibility and better serve customers over the long run, he said.