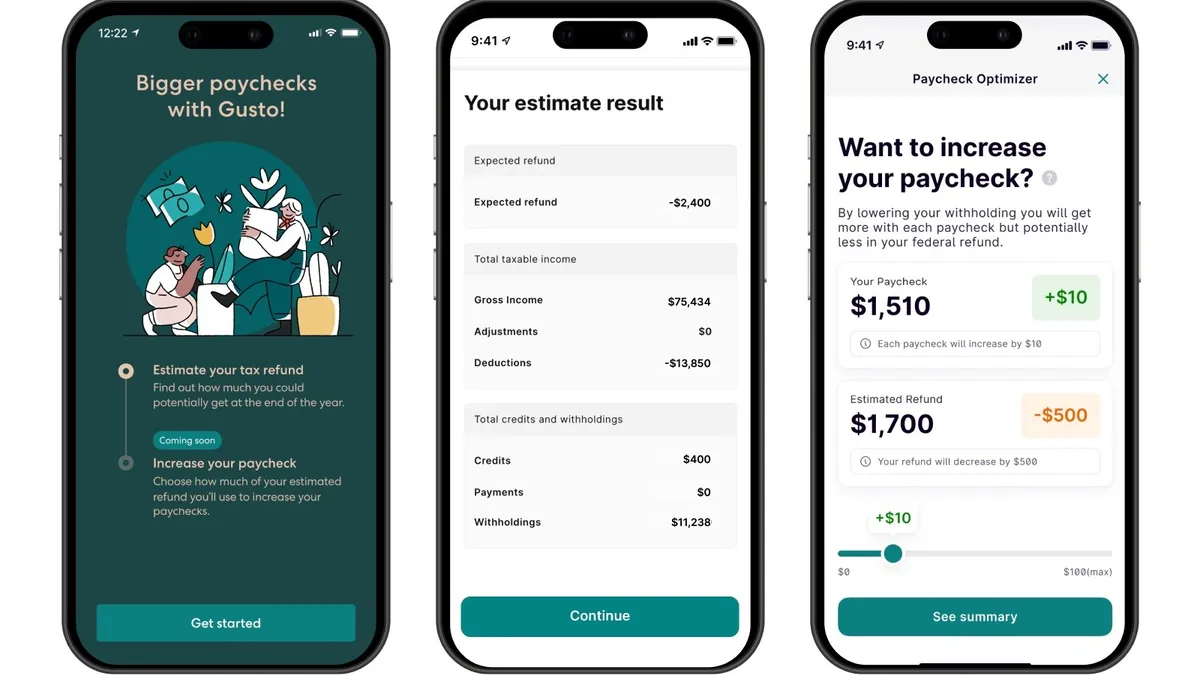

LAS VEGAS — Payroll provider Gusto and artificial intelligence-powered tax fintech april co-launched an embedded tax refund estimator Monday, giving Gusto users the ability to estimate their owed federal taxes and adjust their withholdings accordingly.

The product brings april’s tax tools, which harness the power of machine learning with the goal of taking the surprise out of tax season, to the employees of Gusto’s more than 300,000 client businesses.

“The U.S. tax system remains a complex and constantly evolving process and, as a result, the majority of people either don’t know they can adjust their withholding or don’t know how to estimate their federal tax situation and make the necessary changes before tax season,” Ben Borodach, co-founder and CEO of april, told Banking Dive. “In fact, 64% of Americans don’t know that a W-4 is the form used to adjust the tax withholding on a person’s paycheck.”

“What many don’t realize is that a tax refund means they're giving Uncle Sam an interest-free loan by over-withholding, while 60% of Americans are struggling paycheck to paycheck,” he said.

According to the Internal Revenue Service, the average American overpaid $3,100 on their taxes last year. While that sets them up for a sizable refund, some of those who overpaid may have been better suited to use the funds at another point in the year, without having to file paperwork to get it back.

The Gusto-april partnership, which was announced at Money20/20, also gives employees an understanding of their federal tax standing based on how much they’re earning and withholding at a given time, and lets them know if tax credits or deductions could affect how much money they will owe or get back at year’s end.

The launch follows another recent partnership for Gusto: JPMorgan Chase announced in September that it would offer small and midsize businesses embedded payroll services powered by Gusto, according to a recent company blog post.

april itself launched earlier this year with 12 inaugural partners, including Acorns and Mercury Financial.

"We're really focused on helping all financial companies increase access and availability of tax services to their customers and let any American understand their tax position at any moment in time," Borodach told Axios at the time.

Borodach projects that AI could have a marked effect on how taxes are addressed in the future.

“If the first innovation in tax software was going from analog to digital, the next one will be from digital to intelligent,” he told Banking Dive.

“The problem that we have today is that tax is essentially on an island, and it’s a retrospective exercise,” he said. “Because solutions that optimize every day haven’t existed, people try their best to figure out every tax implication they’ve incurred over the last year, but don’t actually get a holistic picture of their situation.

“New solutions are needed to change this retrospective paradigm, and generative AI allows us to speed up the time to market for new tax products that target different segments of the market,” he added.