Editor’s note: This story is part of a series on the trends that will shape the industry in 2021. You can find all the articles on our trendline.

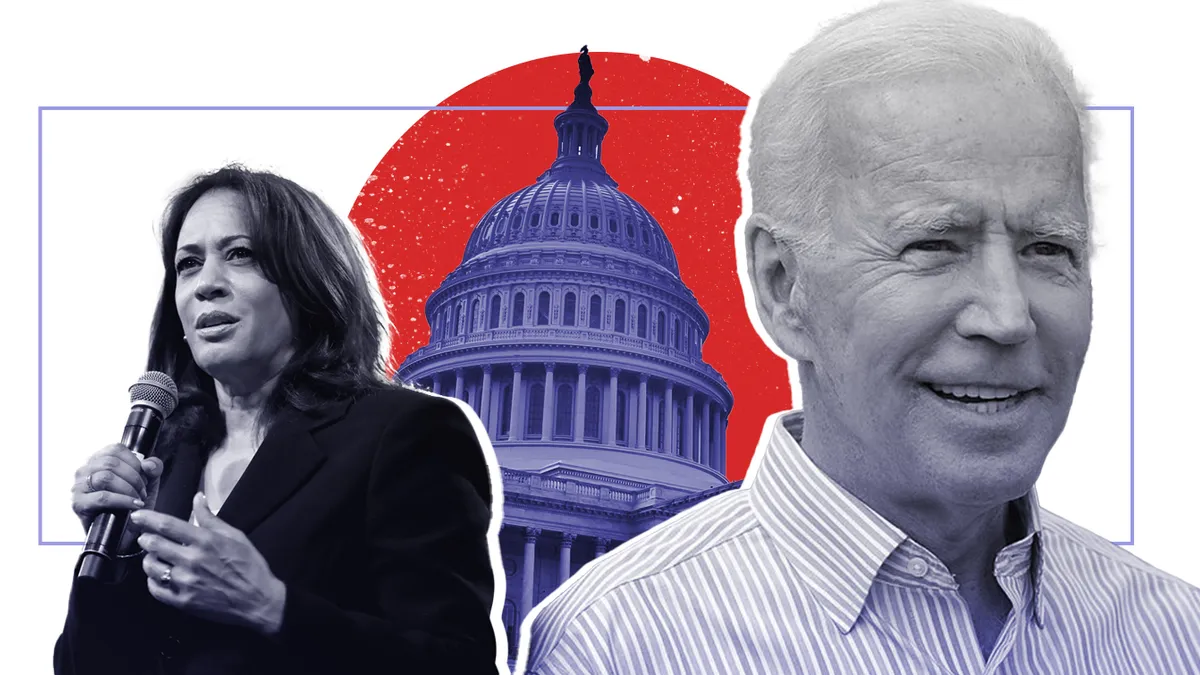

After President Joe Biden’s inauguration Wednesday, and a Georgia runoff election that gave Democrats control of the Senate, the financial regulation and policy agenda looks to be in Democrats' hands for at least the next two years.

Banking industry stakeholders said some of the issues earning the new administration's focus are alternative credit data, big-bank oversight and fair lending.

"Alternative data is going to become incredibly important, and the Biden administration has signaled some real openness to that," said John Pitts, head of policy at data aggregator Plaid.

Coming off a year where student loans and mortgage payments have been paused amid the coronavirus pandemic, consumers are facing big gaps in credit history.

Among his first actions as president, Biden signed an executive order Wednesday directing the Department of Education to extend the pause on student loan payments through Sept. 30.

"This is the longest period of significant regulatory dampening of normal financial services information that we've ever seen," Pitts said. "We're going to have a year's worth of irrelevant information on people’s credit reports, and we've never really had an environment like that."

As a result, Pitts said he thinks cash flow underwriting will become an important practice during the Biden administration.

"This is an area where fintechs really have been the leaders in for the last five years, and large financial institutions have always done with small businesses but not done as frequently with consumers," he said. "I think having leadership at the [Office of the Comptroller of the Currency] and the [Consumer Financial Protection Bureau] who are leaning into those types of innovations and making sure that consumers are protected when they do them will be incredibly important."

With Democrats heading the financial services and banking committees in the Senate and House, major bank CEOs should expect an increase in bank oversight hearings.

Sen. Sherrod Brown, D-OH, who will replace Sen. Mike Crapo, R-ID, as Senate Banking Committee chair, is expected to ramp up oversight of the sector and has expressed a desire to hear from the CEOs of the nation’s largest banks more often.

"[T]hey have a lot of power and we need to know more about how they do their business," he told reporters last week. "The more we hear from them, the better."

Bank CEOs may benefit from some extra time to prepare for future congressional hearings, as Democrats may want to postpone some of the "blockbuster" ones until after the pandemic subsides, said Aaron Cutler, a partner in Hogan Lovells's government affairs unit.

"It's not as dramatic to have people raise their hands and swear in over Zoom as opposed to in the committee room," he said.

In the meantime, Cutler said banks should be preparing testimony and managing responses to topics that Democrats will likely be focused on, such as diversity and inclusion, fair lending and climate change.

"Fair lending is one of the areas that moves back and forth with the party affiliation of the administration, more than really other kinds of financial services regulation," said Christopher Willis, co-leader of Ballard Spahr's consumer financial services group. "We're expecting an increase in fair lending attention under this administration. It’s a particular area of law that banks have to be concerned about."

The Obama administration actively enforced anti-discrimination laws, such as the Equal Credit Opportunity Act and the Fair Housing Act, while the Trump administration took the opposite approach, Willis said.

"That's an area where, historically, you see a lot more in a Democratic administration, and so we're expecting that to occur again," Willis said.

Despite Democratic control of the House and Senate, the margins are still too tight for lawmakers to pass any significant bills that could impact banking, Cutler said. But, he added, leadership changes at regulatory agencies will have a greater impact on the sector.

Biden appointed nine-year CFPB veteran Dave Uejio, who last served as the bureau's chief strategy officer, as the agency's acting chief after CFPB Director Kathy Kraninger resigned, the White House announced Thursday, according to Reuters.

Rohit Chopra, a member of the Federal Trade Commission, has been floated as a likely pick to head the CFPB on a permanent basis.

The president is also expected to nominate former Ripple adviser and Treasury Department official Michael Barr as head of the OCC, The Wall Street Journal reported Wednesday.