Page 3

-

Northern Trust exec: Crypto rule changes may ease tokenization

Biden-era anti-crypto regulations didn’t just affect volatile digital assets. They also affected firms offering traditional assets, like bonds, on the blockchain.

-

Column

Dive Deposits: If you’re looking for the old CFPB, it moved north

New York’s financial regulator hired a top ex-CFPB enforcement official. Meanwhile, the bureau’s former director, Rohit Chopra, contributed to the state’s announcement of a tougher consumer protection bill.

-

JPMorgan: Women unlikely to reach parity with men for 134 years

In C-suites worldwide, women are far from attaining equal status, holding only about 10% of the most powerful roles such as CEO and CFO.

-

Mercury to pivot from partner bank Evolve

The decision to sever ties with Evolve follows neobank Dave’s decision to line up Coastal Community Bank as its new partner.

-

US banks turn to SEC to dodge climate, social shareholder proposals

The agency has largely denied the requests, ruling that banks must put the requests to disclose its clean energy financing ratios and indigenous rights practices to a vote.

-

TD names new US consumer-bank leaders amid branch closures

The 38 branch closures follow “business-as-usual reviews” and come as the bank names two executives to bolster its retail operations.

-

Webster eyes $100B threshold, invests in hiring and tech

The Connecticut-based bank aims to hire about 200 people this year, including adding about two dozen technology and cybersecurity employees, Webster’s CIO said.

-

CFPB must rehire terminated probationary employees: court

Workers received no advance notice or performance-based assessments ahead of the dismissals, a judge ruled. A judge in a separate case said he would not prevent CFPB leaders from returning the bureau’s reserve funds.

-

Citi revamps tech leadership in its wealth division

Dipendra Malhotra, former head of analytics, AI and data at Morgan Stanley's wealth unit, will help drive technology modernization at Citi, CIO Jonathan Lofthouse said.

-

Fed drops enforcement action against Lake Shore Savings Bank

The central bank terminated its enforcement action last week, about three months after the Office of the Comptroller of the Currency dropped its consent order against the lender.

-

CFPB strikes down DEI efforts

The bureau’s acting director halted “race-based” activities, forbade pronouns in email signatures and equated noncompliance to “gross insubordination.”

-

Wells Fargo taps Discover, JPMorgan vet to lead branch, ATM tech unit

Heather Blair served as senior vice president of consumer banking technology at Discover for more than a year. She also spent 17 years at JPMorgan Chase, including as head of technology.

-

Q&A

Citi pursues partnerships to elevate its pay-over-time tool

The bank doesn’t need partnerships for its credit card customers to access Flex Pay, but tie-ups offer customer convenience and visibility, said Citi’s Jeff Chwast.

-

Brex strives for predictability after operational overhaul

After the company laid off 20% of its employees last January and changed the way it puts out products, Brex COO Camilla Matias has high hopes for what’s coming.

-

CIBC CEO Victor Dodig to retire in October

Harry Culham, the lender’s capital-markets chief, will succeed Dodig at the helm of Canada’s fifth-largest bank.

-

Illinois’ NuMark Credit Union to buy in-state bank

The deal for The Lemont National Bank, expected to close in the second half of 2025, is the second proposed acquisition of a bank this year by a credit union.

-

Judge in CFPB case ‘leaning’ toward injunction

Efforts to gut the bureau may still be going forward. A defense attorney, meanwhile, tried to highlight the differences between DOGE’s actions and those of the CFPB’s new leadership.

-

NYDFS chief details changes spurred by Signature failure

The regulator implemented new escalation protocols and an operational stress testing exercise to keep a closer eye on the “C students” under its watch, Adrienne Harris said Tuesday.

-

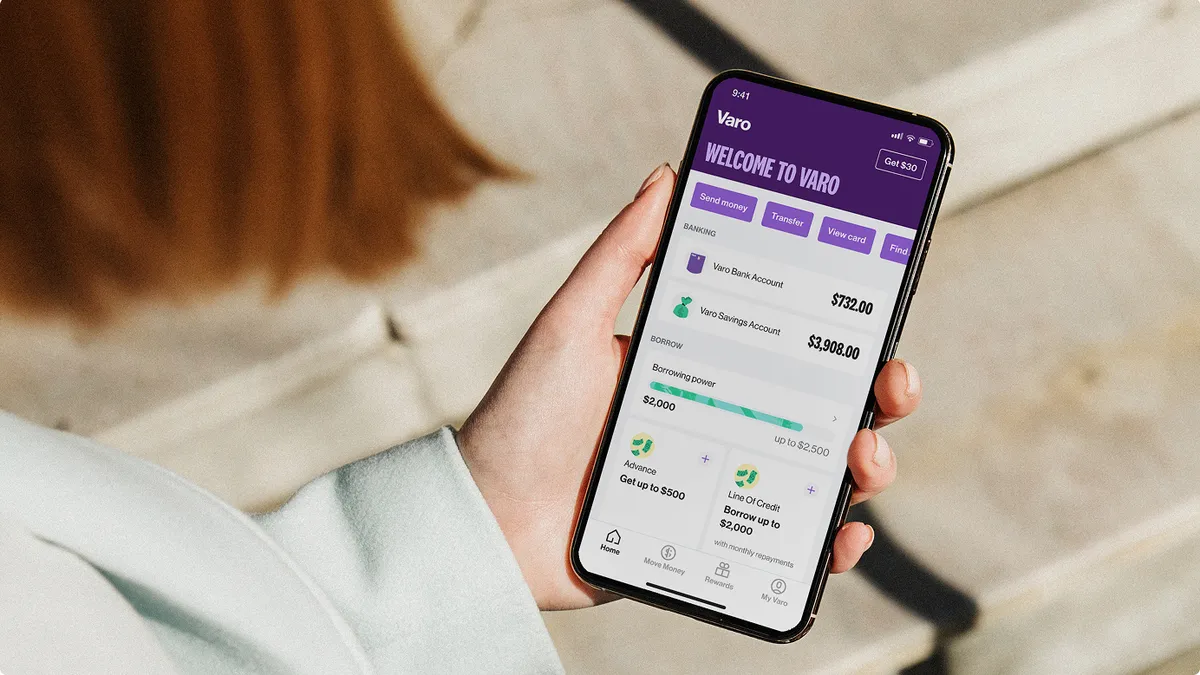

Varo to leverage AI, machine learning in profitability push

Incoming Varo Bank CEO Gavin Michael said he plans to achieve profitability by capitalizing on technology for underwriting and fraud prevention.

-

Ex-PNC exec was ready to lead Fiserv at ‘the speed of Mike,’ CFO says

“I would say probably 10 days into that transition, [Fiserv CEO] Frank [Bisignano] declared the transition over internally,” CFO Bob Hau said.

-

Q&A

Pathward CEO: Regulatory scrutiny of BaaS ‘just getting started’

Regulators will keep BaaS under the microscope, continuing to put pressure on the space and contributing to fewer banks in the space, expects Brett Pharr, the bank’s CEO.

-

Wells Fargo sues JPMorgan over $481M CRE loan

JPMorgan failed to conduct due diligence on the commercial real estate loan, then quickly offloaded the risk, “taking home millions of dollars of fees in the process,” Wells asserted.

-

Warren slams Fed over accountability on SVB execs

On the second anniversary of the bank’s failure, the senator chastised the central bank for failing to complete rulemakings to prevent similar future collapses.

-

Capital One co-founder sees a ‘generation’ of fintech IPOs soon

“Fintech levels the playing field,” said Nigel Morris, who runs venture-capital firm QED Investors. “Fintech takes away the power hegemony between incumbent and individual.”

-

Green Dot considers sale as CEO exits

The embedded finance company, which posted a loss last year, hired Citi to explore its strategic options and named an interim CEO.

To find more content, use the "Topics" in the menu above.