Dive Brief:

- Truist acquired San Francisco-based Long Game, a gamified finance app, for an undisclosed amount, the bank announced Tuesday.

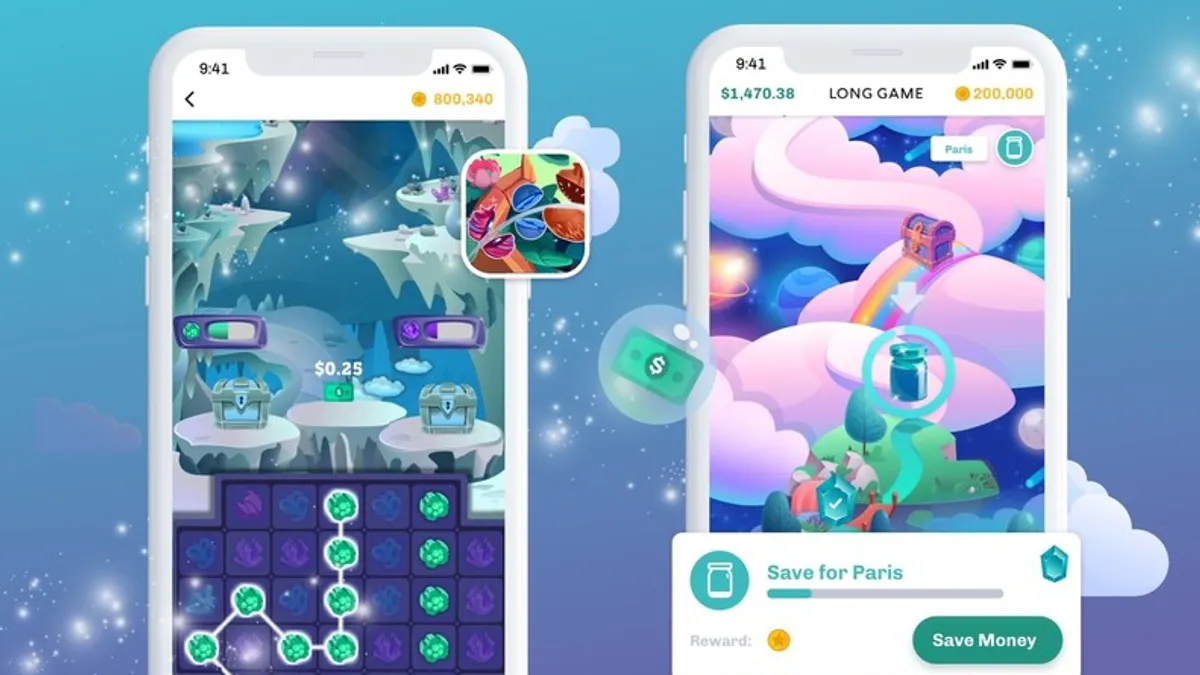

- Long Game, which was launched in 2015 by co-founder and CEO Lindsay Holden, uses prize-linked games to encourage smart financial habits and saving. The startup aims to help banks and credit unions with client retention and account growth, particularly among Gen Z and millennial customers.

- As part of the acquisition, Long Game's engineers, designers and business leaders will join Truist's innovation team, the Charlotte, North Carolina-based bank said in a release. Holden will continue to head the startup, which will remain headquartered in San Francisco.

Dive Insight:

Truist’s acquisition of Long Game is a clear attempt to tap the Gen Z crowd, a demographic that is in the early stages of establishing their banking relationships.

A study by financial data platform MX found that just 47% of Gen Z respondents claimed to have an account with a traditional bank, credit union, neobank or technology company. That’s compared to 75% of baby boomers and 70% of millennials.

"Millennials and Gen Zs are set to become the most important customer group for most banks and credit unions over the next decade, as nearly $70 trillion in wealth transfers to them from their parents,” Finn AI CEO Jake Tyler said in a statement accompanying the MX report.

Long Game, on average, sees daily engagement from its users, Holden told Banking Dive in an interview last year.

“There's an 80% long-term retention with the customers that use Long Game, so it's a very sticky product,” she said in November. “It's a digital tool that resonates with a user group that's traditionally pretty hard for banks and credit unions right now.”

Long Game was partnering with 11 banks and credit unions as of November, Holden said.

Vanessa Vreeland, head of corporate development at Truist Ventures, told TechCrunch the bank views itself as a “giant startup,” adding it’s looking for ways to deepen its relationship with customers.

“We thought, ‘What better way to really engage with our clientele and attract new clients from younger generations to Truist than by offering a really exciting gamified way to save and to engage with personal finances?’” she told the outlet.

Gamification in finance has not always carried a positive connotation. Massachusetts securities regulators sued stock-trading app Robinhood in December 2020, claiming the company's emoji-adorned messages and repeated in-app prompts to customers were meant to push users toward more frequent engagement and riskier investment products. Regulators also called out the confetti animation the company once used to mark customers' first trades.

Ken Meyer, Truist’s CIO for consumer technology and innovation, said the Long Game deal is a critical component of the bank’s broader innovation strategy.

“[The acquisition] will future-proof our core businesses and attract inventive and entrepreneurial talent to help deliver new and groundbreaking solutions," he said in a statement. "We're incredibly excited to welcome Lindsay and the Long Game team as we roll out this strategy and create new and distinctive experiences for our clients."

Long Game's architecture is aligned with Truist's existing technology stack and is complementary to Truist Momentum, “a workplace financial wellness program that educates, equips and inspires employees to manage their money based on what matters most to them," the bank said.