Dive Brief:

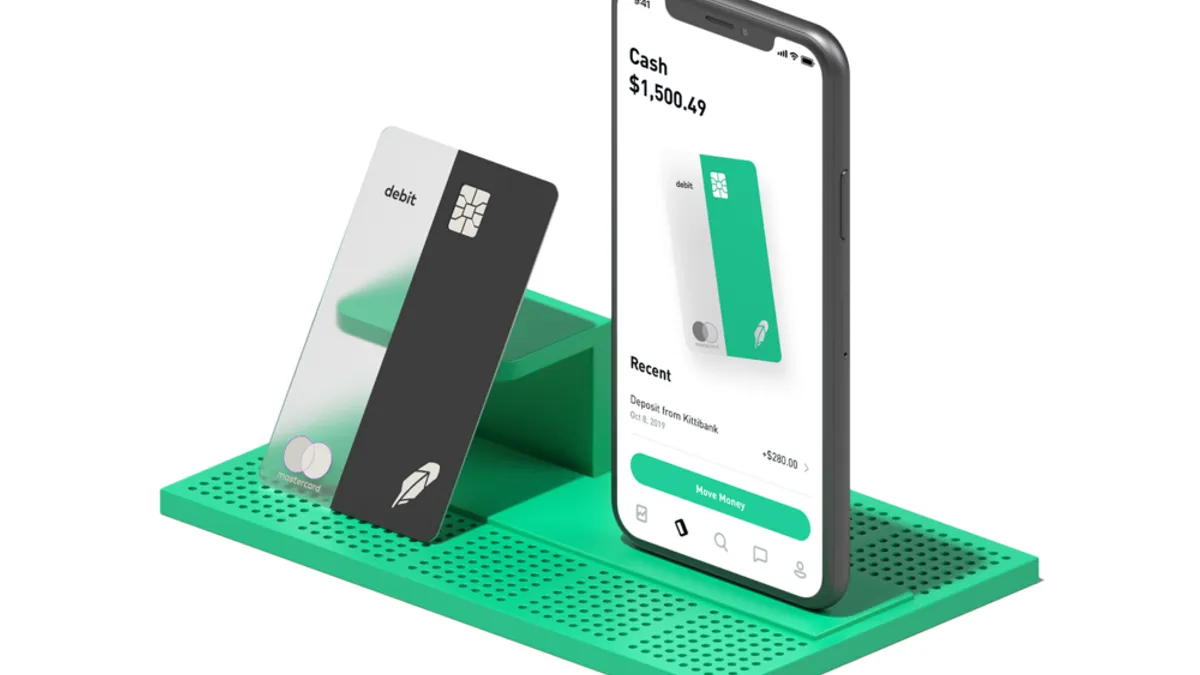

- Stock trading app Robinhood is offering a high-yield cash management account after it failed to launch the product in mid-December.

- The company's first savings account endeavor was halted after it neglected to notify the Securities and Exchange Commission (SEC) or the Securities Investor Protection Corp. (SIPC) ahead of the launch. A day after its announcement, the company said it would rebrand and rename the product following pushback from regulators.

- "We believe our financial system should work for you and do more for your money," the company said in a blog post. "To help get us there, we announced plans in December to launch a new product. We made mistakes with that announcement, which led us to hit the reset button and start over from scratch."

Dive Insight:

Robinhood is partnering with Goldman Sachs, HSBC, Wells Fargo, Citibank, Bank of Baroda and U.S. Bank to offer the 2.05% interest rate account, according to CNBC.

The financial services company joins a growing category of nonbank fintechs who partner with banks to offer Federal Deposit Insurance Corp. (FDIC)-insured products, such as savings and checking accounts.

Robo-advisers Betterment and Wealthfront both launched high-yield accounts this year. Betterment initially boasted a 2.69% annual percentage yield (APY), but it has since lowered that figure to 2.04%. Wealthfront promises 2.07%.

More recently, credit monitoring service Credit Karma also entered the high-yield account fray, announcing Thursday that it would offer its first banking product, a savings account with a 2.03% APY.

While the 2.05% APY for Robinhood's new cash management account places it close to its fintech competitors, it's well above the national average of 0.10%, according to Bankrate.com.