It’s 2021. It’s the height of the pandemic, and fintech professional Sophia Goldberg has been glued to her newest obsession, a social audio app, for connection and entertainment.

The app monetized, launching a feature where users could tip their favorite creators. With that, an aha moment came for Goldberg.

“That meant, if I'm gonna send you 50 cents, I pull out my credit card, and [the app] loses money on that transaction. There's just no way you can do a 50 cent transaction on a credit card and not lose money,” she said.

Merchants pay fees on transactions, including interchange fees and processing fees, that in some cases add up to as much as 12.5% of the total transaction amount.

Goldberg, in her words, got a bee in her bonnet about it. Passionate about payments, she had an idea of how it should be done differently.

“They should let people have balances that you, say, load $20 into that you can tip across the platform, and [maybe even] earn into it, and really have this on-platform economy,” she said. “At that point, I knew what the solution should be for them, but I didn't know that there wasn't a vendor or platform out there that could support that.”

It was through this realization, and her own ethos that payments is a “utility for commerce, that and we're there to help support growing industries and new ways to pay,” that she developed the idea for Ansa, a white-labeled wallet product merchants can weave into their own apps to both cut the cost of fees and to enhance customer loyalty.

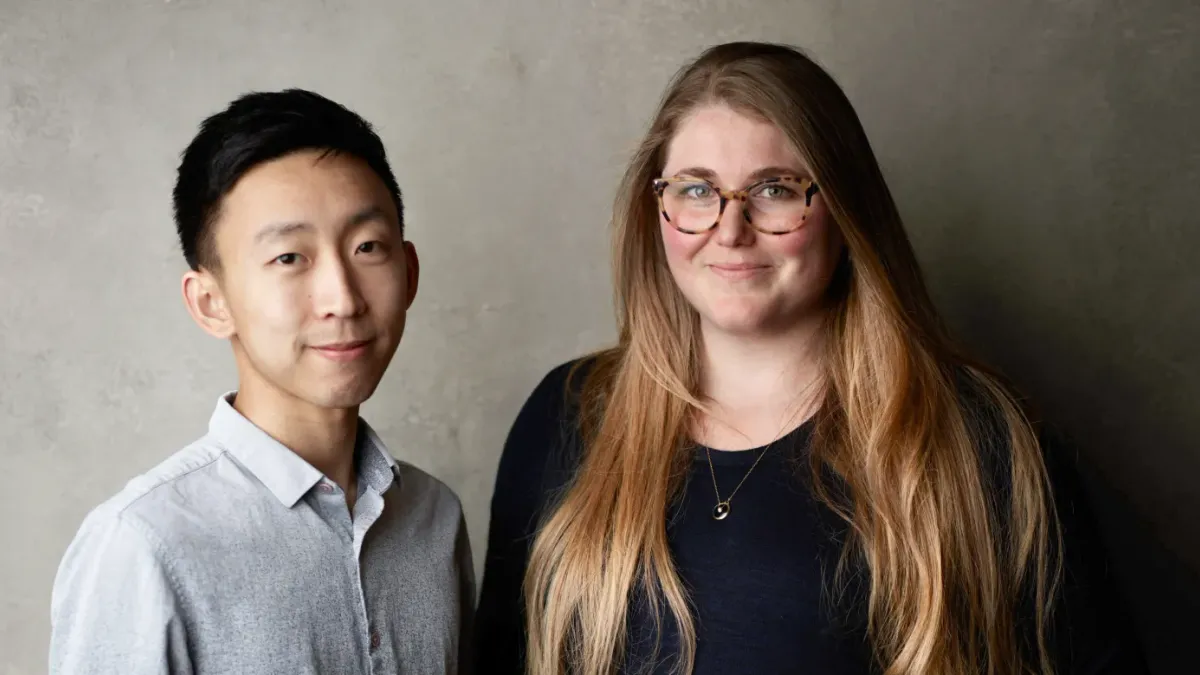

She built Ansa with JT Cho, a former Affirm software engineer.

Commerce has out-innovated payments, Goldberg explained, so it’s important to build payments tools for specific use cases. Americans and the merchants they shop at heavily rely on payment cards, but there are many uses, she said, that they’re not the best option for: specifically for HULT – habitual use, low transaction-value – merchants, like coffee chains and quick-service restaurants.

While some merchants, like Starbucks and Uber, have undertaken the challenge of launching a wallet on their own, Ansa’s white-labeled wallets make the prospect accessible and quicker to implement, according to Goldberg.

With Ansa, “a brand doesn't have to maintain, or innovate on, what is at its core really tricky and regulated payments infrastructure,” Goldberg said.

“What we're really excited about being able to do is let brands focus on what matters most to them, which is investing in products and customer experience,” she said. “And we can own all of the nitty gritty ‘how the sausage gets made’ behind the scenes, and serve up APIs that let them [offer] this payments product without having to worry about how it works and scales for them.”

Ansa launched with its first customer, San Francisco-based local coffee chain Red Bay Coffee, eight months ago. Red Bay Coffee launched a wallet within its order-ahead app, allowing Red Bay customers to hold balances from which to pay for their daily cappuccino – without Red Bay or the customer getting dinged with fees each time.

It’s since launched with several other customers. Goldberg wouldn’t specify how many, but she said that the launches have highlighted the cost savings potential of a wallet. which for some of Ansa’s customers has amounted to a 50% savings in fees.

But it’s also highlighted something more.

“What a wallet really is is a retention tool. We see a really big increase in frequency and revenue per loyal customer if you can transition them to a wallet,” she said. “The revenue impact flywheel of a wallet has kind of overshadowed the initial impetus for this product, which was the idea that this could be a cost savings tool, and we realized that's in some ways the least exciting part for brands when they launch a wallet.”